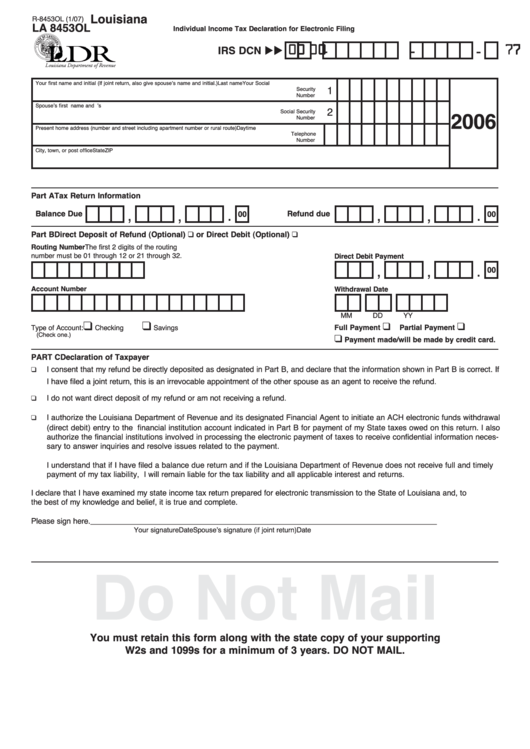

La Form 8453ol - Louisiana Individual Income Tax Declaration For Electronic Filling (2006)

ADVERTISEMENT

Louisiana

R-8453OL (1/07)

LA 8453OL

Individual Income Tax Declaration for Electronic Filing

0 0 0 0

7 7

-

-

-

IRS DCN

Your first name and initial (If joint return, also give spouse’s name and initial.)

Last name

Your Social

1

Security

Number

Spouse’s first name and initial.

Last name

Spouse’s

2

Social Security

2006

Number

Present home address (number and street including apartment number or rural route)

Daytime

Telephone

Number

City, town, or post office

State

ZIP

Part A

Tax Return Information

,

,

.

,

,

.

Balance Due

Refund due

00

00

Direct Deposit of Refund (Optional) ❑ or Direct Debit (Optional) ❑

Part B

Routing Number The first 2 digits of the routing

number must be 01 through 12 or 21 through 32.

Direct Debit Payment

,

,

.

00

Account Number

Withdrawal Date

MM

DD

YY

❑

❑

❑

❑

Full Payment

Partial Payment

Type of Account:

Checking

Savings

(Check one.)

❑

Payment made/will be made by credit card.

PART C

Declaration of Taxpayer

❑

I consent that my refund be directly deposited as designated in Part B, and declare that the information shown in Part B is correct. If

I have filed a joint return, this is an irrevocable appointment of the other spouse as an agent to receive the refund.

❑

I do not want direct deposit of my refund or am not receiving a refund.

❑

I authorize the Louisiana Department of Revenue and its designated Financial Agent to initiate an ACH electronic funds withdrawal

(direct debit) entry to the financial institution account indicated in Part B for payment of my State taxes owed on this return. I also

authorize the financial institutions involved in processing the electronic payment of taxes to receive confidential information neces-

sary to answer inquiries and resolve issues related to the payment.

I understand that if I have filed a balance due return and if the Louisiana Department of Revenue does not receive full and timely

payment of my tax liability, I will remain liable for the tax liability and all applicable interest and returns.

I declare that I have examined my state income tax return prepared for electronic transmission to the State of Louisiana and, to

the best of my knowledge and belief, it is true and complete.

Please sign here. ____________________________

__________

____________________________

______________

Your signature

Date

Spouse’s signature (if joint return)

Date

Do Not Mail

You must retain this form along with the state copy of your supporting

W2s and 1099s for a minimum of 3 years. DO NOT MAIL.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1