Power Of Attorney

Download a blank fillable Power Of Attorney in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Power Of Attorney with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

Print and Reset Form

Reset Form

STATE OF CALIFORNIA

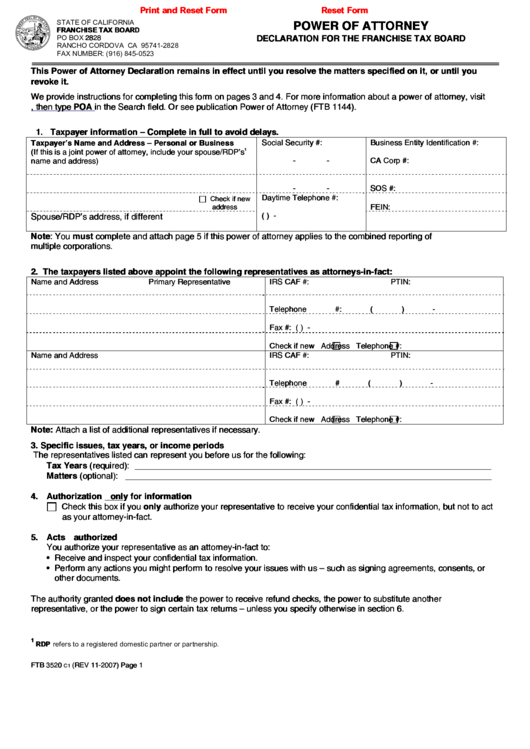

POWER OF ATTORNEY

FRANCHISE TAX BOARD

PO BOX 2828

DECLARATION FOR THE FRANCHISE TAX BOARD

RANCHO CORDOVA CA 95741-2828

FAX NUMBER: (916) 845-0523

This Power of Attorney Declaration remains in effect until you resolve the matters specified on it, or until you

revoke it.

We provide instructions for completing this form on pages 3 and 4. For more information about a power of attorney, visit

, then type POA in the Search field. Or see publication Power of Attorney (FTB 1144).

1. Taxpayer information – Complete in full to avoid delays.

Taxpayer’s Name and Address – Personal or Business

Social Security #:

Business Entity Identification #:

1

(If this is a joint power of attorney, include your spouse/RDP’s

name and address)

-

-

CA Corp #:

-

-

SOS #:

Daytime Telephone #:

Check if new

FEIN:

address

(

)

-

Spouse/RDP’s address, if different

Note: You must complete and attach page 5 if this power of attorney applies to the combined reporting of

multiple corporations.

2. The taxpayers listed above appoint the following representatives as attorneys-in-fact:

Name and Address

Primary Representative

IRS CAF #:

PTIN:

Telephone #:

(

)

-

Fax #:

(

)

-

Check if new

Address

Telephone #:

Name and Address

IRS CAF #:

PTIN:

Telephone #

(

)

-

Fax #:

(

)

-

Check if new

Address

Telephone #:

Note: Attach a list of additional representatives if necessary.

3. Specific issues, tax years, or income periods

The representatives listed can represent you before us for the following:

Tax Years (required): ___________________________________________________________________________

Matters (optional): _____________________________________________________________________________

4. Authorization only for information

Check this box if you only authorize your representative to receive your confidential tax information, but not to act

as your attorney-in-fact.

5. Acts authorized

You authorize your representative as an attorney-in-fact to:

• Receive and inspect your confidential tax information.

• Perform any actions you might perform to resolve your issues with us – such as signing agreements, consents, or

other documents.

The authority granted does not include the power to receive refund checks, the power to substitute another

representative, or the power to sign certain tax returns – unless you specify otherwise in section 6.

1

RDP refers to a registered domestic partner or partnership.

FTB 3520

(REV 11-2007) Page 1

C1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5