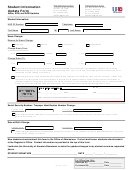

Student Loan Deferment Form - University Of Maryland Page 2

ADVERTISEMENT

This form will be returned to the borrower if it is incomplete

A. Student - Full time / Half -time –

Selected Institutional Loans- To receive an in-school deferment, the borrower must be enrolled as a regular student in an eligible institution of higher

education or a comparable institution outside the United States approved by the Department for deferment purposes. A regular student is one who is enrolled

for the purpose of obtaining a degree or certificate.

Nursing Loans- NSL borrowers who have entered repayment may receive additional deferments for up to 10 years for full-time or half-time enrollment in a

collegiate nursing school. The program in which the borrower is enrolled must lead to a baccalaureate or a graduate degree in nursing.

Health Profession Loans- Graduates of health professions schools who borrowed HPSL funds are also eligible for deferments if they participate in certain

educational activities. The educational activity must be directly related to the health profession for which the borrower obtained the HPSL. In addition, the

borrower must enter into the activity either prior to the end of his/her advanced professional training or no later than 12 months after the borrower completed

participation in that advanced professional training.

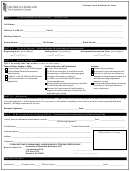

The related educational activity must meet one of the following criteria for the borrower to obtain a deferment:

•

The activity must be part of a joint-degree program in conjunction with the health professions program for which the borrower received the HPSL;

•

The activity is required for licensure, registration or certification in the health profession for which the borrower received the HPSL;

•

The activity is a full-time educational program in public health, health administration, or a health care discipline directly related to the health

profession for which the borrower received the HPSL.

B.

Internship or Residency or Advanced Professional Training-

Institutional Loans- refer to the individual promissory note for terms and conditions.

Nursing Loans- pursuing advanced training in nursing or are engaged in training to become a nurse anesthetist. The regulations define advanced training

in nursing as full-time or half-time training beyond the borrower's first diploma or degree in nursing. Advanced training must:take one year or longer to

complete; and strengthen the borrower's skills in the provision of nursing services.

Health Profession Loans- Borrowers can qualify for deferment on the basis of advanced professional training for the duration of that training if it is:

•

intended to further the borrower's knowledge and skills in the health professions discipline for which the loan was received;

•

a prerequisite for professional practice; and

•

an internship or residency program or other full-time training beyond the first professional degree.

C. Volunteer Peace Corps –

Nursing Health Profession and Selected Institutional Loans -Borrowers who volunteer under the Peace Corps Act are eligible for deferment for up to three

years. Such service performed during the grace period does not count as part of the maximum deferment period for which the borrower is eligible, nor does it

entitle the borrower to a grace period after the deferment period ends.

D. Graduate / Fellowship –

Health Profession Loans- Graduates of health professions schools who borrowed HPSL funds are eligible for deferments if they participate in certain

fellowship training programs. The fellowship training must be directly related to the health profession for which the borrower obtained the HPSL. In addition,

the borrower must enter into the fellowship either prior to the end of his/her advanced professional training or no later than 12 months after the borrower

completed participation in that advanced professional training. The fellowship training itself must meet certain criteria in order for the borrower to obtain the

deferment. Specifically, the fellowship training must be a:

•

full-time activity in research, research training or health care policy; and

•

formally established fellowship program which was not created solely for the borrower.

E.

Active Duty in Uniformed Services – Nursing, Health Profession and Institutional Loans-Borrowers who perform active duty as a member of a

uniformed service (Army, Navy, Marine Corps, Air Force, Coast Guard, the National Oceanic and Atmospheric Administration Corps, or the U.S. Public

Health Service Commissioned Corps) are eligible for deferment for up to three years.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2