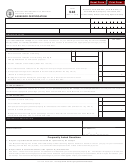

8.

52.204-3 - TAXPAYER IDENTIFICATION (JUN 1997)

(a)

Definitions.

“Common parent,” as used in this solicitation provision, means that corporate entity that owns or controls an affiliated

group of corporations that files its Federal income tax returns on a consolidated basis, and of which the offeror is a

member.

“Taxpayer Identification Number (TIN),” as used in this solicitation provision, means the number required by the IRS to

be used by the offeror in reporting income tax and other returns. The TIN may be either a Social Security Number or an

Employer Identification Number.

(b)

All offerors must submit the information required in paragraphs (d) through (f) of this provision to comply with debt

collection requirements of 31 U.S.C. 7701(c) and 3325(d), reporting requirements of 26 U.S.C. 6041, 6041A, and

6050M, and implementing regulations issued by the IRS. If the resulting contract is subject to the payment reporting

requirements described in Federal Acquisition Regulation (FAR) 4.904, the failure or refusal by the offeror to furnish the

information may result in a 31 percent reduction of payments otherwise due under the contract.

(c)

The TIN may be used by the Government to collect and report on any delinquent amounts arising out of the offeror’s

relationship with the Government (31 U.S.C. 7701(c)(3)). If the resulting contract is subject to the payment reporting

requirements described in FAR 4.904, the TIN provided hereunder may be matched with IRS records to verify the

accuracy of the offeror’s TIN.

(d)

Taxpayer Identification Number (TIN).

*

TIN:_____________________.

*

TIN has been applied for.

*

TIN is not required because:

*

Offeror is a nonresident alien, foreign corporation, or foreign partnership that does not have income effectively

connected with the conduct of a trade or business in the United States and does not have an office or place of

business or a fiscal paying agent in the United States;

*

Offeror is an agency or instrumentality of a foreign government;

*

Offeror is an agency or instrumentality of the Federal government;

(e)

Type of organization.

*

Sole proprietorship;

*

Partnership; Not a corporate entity:

*

Corporate entity (not tax-exempt);

*

Corporate entity (tax-exempt);

*

Government entity (Federal, State, or local);

*

Foreign government;

*

International organization per 26 CFR 1.6049-4;

*

Other ______________________.

(f)

Common Parent.

*

Offeror is not owned or controlled by a common parent as defined in paragraph (a) of this provision.

*

Name and TIN of common parent:

Name_______________________________

TIN________________________________

9.

OFFEROR'S DUNS NUMBER (APR 1996)

Enter number, if known:

OFFEROR OR

Name and Address (Including ZIP Code)

Telephone Number

AUTHORIZED

REPRESENTATIVE

Signature

Date

INITIALS:

&

LESSOR

GOVERNMENT

GSA FORM 3518 PAGE 4 (REV 12/99)

1

1 2

2 3

3 4

4