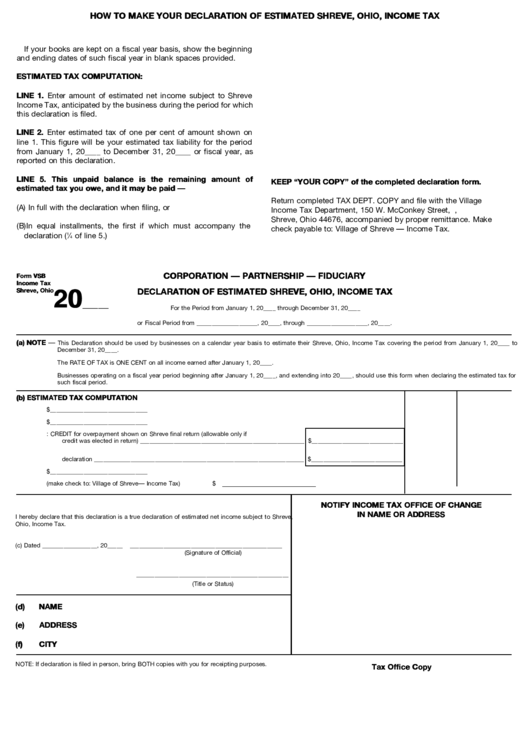

Form Vsb - Corporation - Partnership - Fiduciary Declaration Of Estimated Shreve, Ohio, Income Tax

ADVERTISEMENT

HOW TO MAKE YOUR DECLARATION OF ESTIMATED SHREVE, OHIO, INCOME TAX

If your books are kept on a fiscal year basis, show the beginning

and ending dates of such fiscal year in blank spaces provided.

ESTIMATED TAX COMPUTATION:

LINE 1. Enter amount of estimated net income subject to Shreve

Income Tax, anticipated by the business during the period for which

this declaration is filed.

LINE 2. Enter estimated tax of one per cent of amount shown on

line 1. This figure will be your estimated tax liability for the period

from January 1, 20____ to December 31, 20____ or fiscal year, as

reported on this declaration.

LINE 5. This unpaid balance is the remaining amount of

KEEP “YOUR COPY” of the completed declaration form.

estimated tax you owe, and it may be paid —

Return completed TAX DEPT. COPY and file with the Village

(A) In full with the declaration when filing, or

Income Tax Department, 150 W. McConkey Street, P.O. Box 604,

Shreve, Ohio 44676, accompanied by proper remittance. Make

(B) In equal installments, the first if which must accompany the

check payable to: Village of Shreve — Income Tax.

declaration (

1

⁄

of line 5.)

4

CORPORATION — PARTNERSHIP — FIDUCIARY

Form VSB

Income Tax

20

Shreve, Ohio

DECLARATION OF ESTIMATED SHREVE, OHIO, INCOME TAX

_____

For the Period from January 1, 20____ through December 31, 20____

or Fiscal Period from ____________________, 20____, through ____________________, 20____.

(a) NOTE —

This Declaration should be used by businesses on a calendar year basis to estimate their Shreve, Ohio, Income Tax covering the period from January 1, 20____ to

December 31, 20____.

The RATE OF TAX is ONE CENT on all income earned after January 1, 20____.

Businesses operating on a fiscal year period beginning after January 1, 20____, and extending into 20____, should use this form when declaring the estimated tax for

such fiscal period.

(b) ESTIMATED TAX COMPUTATION

1. ESTIMATED NET INCOME SUBJECT TO SHREVE INCOME TAX ________________________________________________________ $ ________________________________

2. ESTIMATED SHREVE INCOME TAX at one per cent of line 1 ____________________________________________________________ $ ________________________________

3. LESS: CREDIT for overpayment shown on Shreve final return (allowable only if

credit was elected in return) ______________________________________________________ $ ______________________________

4.

PAYMENTS made on prior declaration for the period IF this is an amended

declaration _____________________________________________________________________ $ ______________________________

5. UNPAID BALANCE of estimated 20____ Shreve Income Tax ____________________________________________________________ $ ________________________________

______________________

6. AMOUNT PAID WITH THIS DECLARATION and enclosed herewith (make check to: Village of Shreve — Income Tax)

__________

$

NOTIFY INCOME TAX OFFICE OF CHANGE

IN NAME OR ADDRESS

I hereby declare that this declaration is a true declaration of estimated net income subject to Shreve,

Ohio, Income Tax.

(c) Dated

__________________, 20_____

__________________________________________________

(Signature of Official)

__________________________________________________

(Title or Status)

(d)

NAME

(e)

ADDRESS

(f)

CITY

NOTE: If declaration is filed in person, bring BOTH copies with you for receipting purposes.

Tax Office Copy

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2