BOE-571-R (P2) REV. 18 (05-16) ASSR-524 (REV. 8-16)

2017

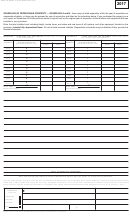

SCHEDULES OF DEPRECIABLE PROPERTY — SCHEDULES A and B. Items may be listed separately within the year of acquisition on

a separate schedule, or items may be grouped by year of acquisition and listed on the schedules below. If you purchased the property as a

unit, report on Schedules A & B the previous owner’s original cost by the original year of acquisition of the furniture and equipment that was

included in your purchase.

Enter the total installed cost including freight, excise taxes, and sales and use taxes of all furniture, and other equipment located on the

premises. Include fully depreciated items. Do not include licensed vehicles. Depreciation schedules may be attached if they provide the

desired information.

OTHER FURNITURE AND EQUIPMENT (office, lobby, laundry,

FURNITURE AND APPLIANCES (include items in storage;

SCHEDULE A

SCHEDULE B

do not include built-ins)

pool, vending, signs, fire extinguishers)

FOR ASSESSOR’S USE ONLY

FOR ASSESSOR’S USE ONLY

Year of

Year of

Original Installed Cost

Original Installed Cost

Acquisition

Acquisition

(NOT depreciated book value)

(NOT depreciated book value)

Factor

Value

Factor

Value

2016

4

2016

1

2015

4

2015

1

2014

4

2014

1

2013

4

2013

1

2012

2012

4

1

2011

2011

4

1

2010

2010

4

1

2009

2009

4

1

2008

2008

4

1

2007

2007

4

1

2006

2006

4

1

& prior

& prior

44

11

TOTAL COST $

TOTAL COST $

Enter on line 8, page 1.

Enter on line 9, page 1.

REMARKS:

DECLARATION BY ASSESSEE

Note: The following declaration must be completed and signed. If you do not do so, it may result in penalties.

I declare under penalty of perjury under the laws of the State of California that I have examined this property statement, including accompanying schedules,

statements or other attachments, and to the best of my knowledge and belief it is true, correct, and complete and includes all property required to be reported

which is owned, claimed, possessed, controlled, or managed by the person named as the assessee in this statement at 12:01 a.m. on January 1, 2017.

SIGNATURE OF ASSESSEE OR AUTHORIZED AGENT*

DATE

t

OWNERSHIP

TYPE (R)

NAME OF ASSESSEE OR AUTHORIZED AGENT* (typed or printed)

TITLE

Proprietorship

NAME OF LEGAL ENTITY (other than DBA) (typed or printed)

FEDERAL EMPLOYER ID NUMBER

Partnership

Corporation

PREPARER’S NAME AND ADDRESS (typed or printed)

TELEPHONE NUMBER

TITLE

Other

(

)

*Agent: See 571-R INST (ASSR-525) for Declaration by Assessee instructions.

1

1 2

2 3

3