Form 13 - Fiduciary'S Account

Download a blank fillable Form 13 - Fiduciary'S Account in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form 13 - Fiduciary'S Account with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

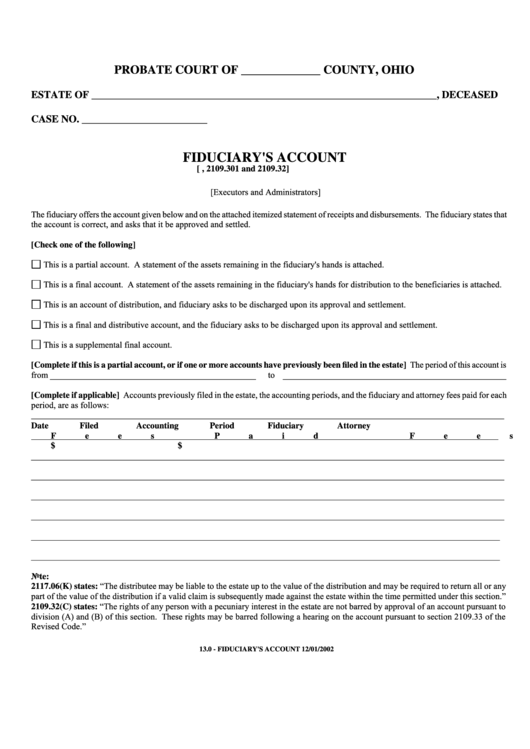

PROBATE COURT OF _____________ COUNTY, OHIO

ESTATE OF __________________________________________________________________, DECEASED

CASE NO. ________________________

FIDUCIARY'S ACCOUNT

[R.C. 2109.30, 2109.301 and 2109.32]

[Executors and Administrators]

The fiduciary offers the account given below and on the attached itemized statement of receipts and disbursements. The fiduciary states that

the account is correct, and asks that it be approved and settled.

[Check one of the following]

This is a partial account. A statement of the assets remaining in the fiduciary's hands is attached.

This is a final account. A statement of the assets remaining in the fiduciary's hands for distribution to the beneficiaries is attached.

This is an account of distribution, and fiduciary asks to be discharged upon its approval and settlement.

This is a final and distributive account, and the fiduciary asks to be discharged upon its approval and settlement.

This is a supplemental final account.

[Complete if this is a partial account, or if one or more accounts have previously been filed in the estate] The period of this account is

from _______________________________________________

to ___________________________________________________

[Complete if applicable] Accounts previously filed in the estate, the accounting periods, and the fiduciary and attorney fees paid for each

period, are as follows:

____________________________________________________________________________________________________________

Date Filed

Accounting Period

Fiduciary

Attorney

Fees Paid

Fees Paid

$

$

____________________________________________________________________________________________________________

____________________________________________________________________________________________________________

____________________________________________________________________________________________________________

____________________________________________________________________________________________________________

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

Note:

2117.06(K) states: “The distributee may be liable to the estate up to the value of the distribution and may be required to return all or any

part of the value of the distribution if a valid claim is subsequently made against the estate within the time permitted under this section.”

2109.32(C) states: “The rights of any person with a pecuniary interest in the estate are not barred by approval of an account pursuant to

division (A) and (B) of this section. These rights may be barred following a hearing on the account pursuant to section 2109.33 of the

Revised Code.”

13.0 - FIDUCIARY'S ACCOUNT

12/01/2002

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2