Form St-13 - Quarterly Return Of Turnover And Sale Tax Payable

ADVERTISEMENT

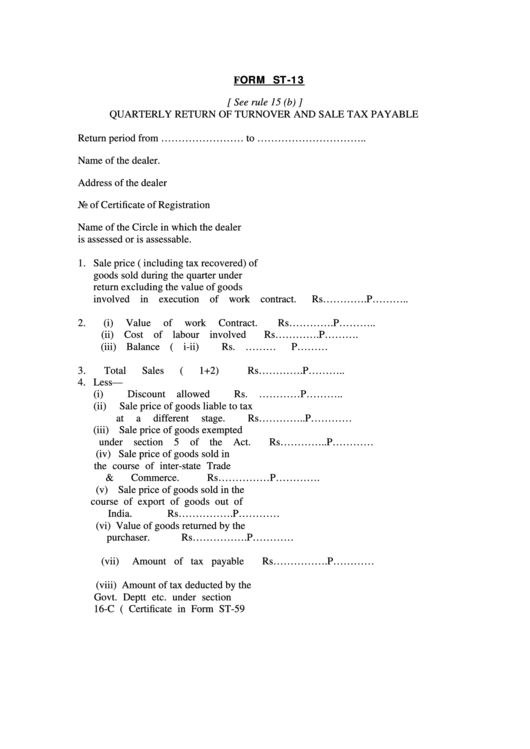

FORM ST-13

[ See rule 15 (b) ]

QUARTERLY RETURN OF TURNOVER AND SALE TAX PAYABLE

Return period from …………………… to …………………………..

Name of the dealer.

Address of the dealer

No of Certificate of Registration

Name of the Circle in which the dealer

is assessed or is assessable.

1. Sale price ( including tax recovered) of

goods sold during the quarter under

return excluding the value of goods

involved in execution of work contract.

Rs………….P………..

2. (i) Value of work Contract.

Rs………….P………..

(ii) Cost of labour involved

Rs………….P……….

(iii) Balance ( i-ii)

Rs. ……… P………

3. Total Sales ( 1+2)

Rs………….P………..

4. Less—

(i)

Discount allowed

Rs. …………P………..

(ii)

Sale price of goods liable to tax

at a different stage.

Rs…………..P…………

(iii) Sale price of goods exempted

under section 5 of the Act.

Rs…………..P…………

(iv) Sale price of goods sold in

the course of inter-state Trade

& Commerce.

Rs……………P………….

(v) Sale price of goods sold in the

course of export of goods out of

India.

Rs…………….P…………

(vi) Value of goods returned by the

purchaser.

Rs…………….P…………

(vii) Amount of tax payable

Rs…………….P…………

(viii) Amount of tax deducted by the

Govt. Deptt etc. under section

16-C ( Certificate in Form ST-59

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2