Employer'S Wage Adjustment Report Development Page 4

ADVERTISEMENT

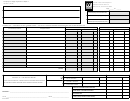

Employer's Wage Adjustment Report

68-0061 (5-15)

Section 1 Instructions:

• Enter 8 digit myIowaUI account number

• Enter 9 digit Federal Employer Identification Number

• Enter Legal Business Name as it appears in myIowaUI

• Enter Year of adjustment

• Enter Reporting Unit number

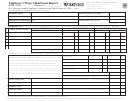

Section 2 Instructions:

• Quarter Wages Earned - enter the quarter in which the wages were earned in another state

• Social Security Number Reported As - enter social security number as reported on original report for Quarter/Year

• Employee Name - enter name of employee in the following format: Last Name, First Name, Middle Initial

• Out of State Taxable Wages Reported - enter the taxable wages reported to the state earned in, other than

Iowa. Taxable wages must be reported by the quarter in which they were earned and not as an

accumulated amount. Credit is determined by which state the employee first met the taxable wage base. If

employees taxable wages combined with Iowa wages exceed the other states taxable wage base then the

credit will be reduced by the amount up to the wage base from which the state credit was requested.

o For example: Employee worked in Nebraska and earned $7000.00 taxable wages for 1

quarter.

st

Employee came to work in Iowa 2

nd

quarter and earned $7000.00. In 3

rd

quarter the employee

worked in Nebraska first and earned $5000.00 then Iowa that same quarter and earned $5000.00.

Credit is given for the $7000.00 earned in Nebraska for the 1

st

quarter but no additional credit given

since taxable wage base of $9000.00 in Nebraska had been met with Iowa's combined taxable

wages.

o The following link will direct you to a list of all State Unemployment Insurance Taxable Wage

Bases:

• State Wages Reported To - enter the two letter state abbreviation in which taxable wages were earned and

reported, other than Iowa

o The following link will direct you to a list of all US State Abbreviations:

• Worked Here Before Iowa Y/N - enter “Y” for yes or “N” for no to show if the employee earned wages in the other

state before wages were earned in Iowa

Section 3 Instructions

:

• Authorized Signature - signature of the individual authorized to make changes to employer's MyIowaUI account

• Preparer's Signature - signature of the individual that is preparing wage adjustment

• Preparer's Title - enter title of individual that is preparing wage adjustment

• Phone - enter phone number of individual to be contacted if Iowa Workforce Development has questions

• Date Submitted - enter date wage adjustment was submitted to Iowa Workforce Development

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4