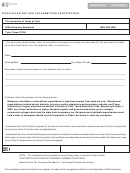

Form 01-925 (Back)(Rev.9-15/3)

Exempt

These items are exempt from sales tax when purchased with a current ag/timber number for exclusive use in producing

timber products for sale.

Axes

Fertilizer fungicides

Recycler grinders

Boards or mats used for access to

Fertilizer spreaders

Repair/replacement parts for

qualified equipment

commercial timber sites

Front end loaders

Bobcats

Grapples

Ropes

Brush cutters

Hand saws

Seedlings of trees grown for

Bulldozers

Harnesses for tree climbing

commercial timber

Skidders

Chain saws

Harvesters

Slasher saws

Chippers

Herbicides

Compressors

Hot saws

Sprinkler systems components

Crawler carriers

Hydro-axes

Stackers

Stump grinders

Defoliants

Insecticides

Tractors

Delimbers

Knucklebooms

Desiccants

Loaders

Tree cutters

Ear protection devices

Lubricants

Tree measurement devices

Tree spades

Excavators

Mobile yarders

Welding machines

Eye protection goggles

Mulching machines

Feller bunchers

Prehaulers

Winches

Taxable

These items DO NOT qualify for sales and use tax exemption for timber production.

• Clothing, including work clothing, safety apparel and shoes

• Computers and computer software used for any purposes other than timber production

• Furniture, home furnishings and housewares

• Golf carts, dirt bikes, dune buggies and go-carts

• Guns, ammunition, traps and similar items

• Materials used to construct roads or buildings used for shelter, housing, storage or work space (examples include

general storage barns, sheds or shelters)

• Motor vehicles and trailers*

• Taxable services such as nonresidential real property repairs or remodeling, security services and waste removal

* See

Tax Help:

Window on State Government:

=

Tax Assistance: 1-800-252-5555

Sign up to receive email updates on the Comptroller topics of your choice at /subscribe.

1

1 2

2