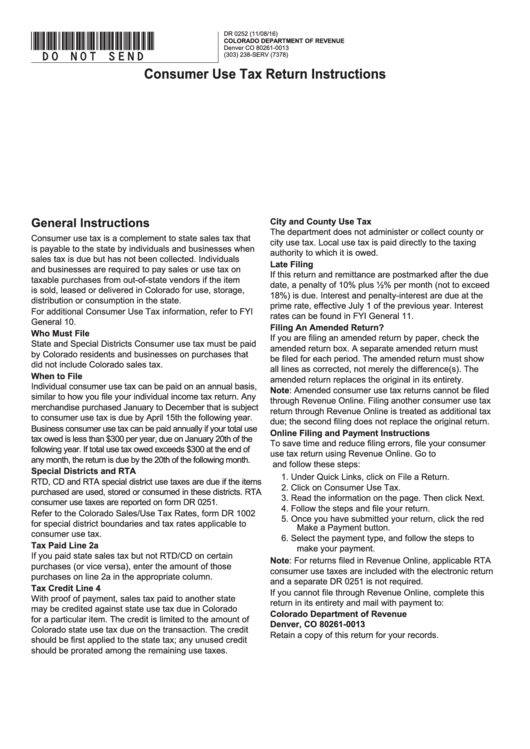

Consumer Use Tax Return Instructions

ADVERTISEMENT

DR 0252 (11/08/16)

*DO=NOT=SEND*

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0013

(303) 238-SERV (7378)

Consumer Use Tax Return Instructions

General Instructions

City and County Use Tax

The department does not administer or collect county or

Consumer use tax is a complement to state sales tax that

city use tax. Local use tax is paid directly to the taxing

is payable to the state by individuals and businesses when

authority to which it is owed.

sales tax is due but has not been collected. Individuals

Late Filing

and businesses are required to pay sales or use tax on

If this return and remittance are postmarked after the due

taxable purchases from out-of-state vendors if the item

date, a penalty of 10% plus ½% per month (not to exceed

is sold, leased or delivered in Colorado for use, storage,

18%) is due. Interest and penalty-interest are due at the

distribution or consumption in the state.

prime rate, effective July 1 of the previous year. Interest

For additional Consumer Use Tax information, refer to FYI

rates can be found in FYI General 11.

General 10.

Filing An Amended Return?

Who Must File

If you are filing an amended return by paper, check the

State and Special Districts Consumer use tax must be paid

amended return box. A separate amended return must

by Colorado residents and businesses on purchases that

be filed for each period. The amended return must show

did not include Colorado sales tax.

all lines as corrected, not merely the difference(s). The

When to File

amended return replaces the original in its entirety.

Individual consumer use tax can be paid on an annual basis,

Note: Amended consumer use tax returns cannot be filed

similar to how you file your individual income tax return. Any

through Revenue Online. Filing another consumer use tax

merchandise purchased January to December that is subject

return through Revenue Online is treated as additional tax

to consumer use tax is due by April 15th the following year.

due; the second filing does not replace the original return.

Business consumer use tax can be paid annually if your total use

Online Filing and Payment Instructions

tax owed is less than $300 per year, due on January 20th of the

To save time and reduce filing errors, file your consumer

following year. If total use tax owed exceeds $300 at the end of

use tax return using Revenue Online. Go to

any month, the return is due by the 20th of the following month.

and follow these steps:

Special Districts and RTA

1. Under Quick Links, click on File a Return.

RTD, CD and RTA special district use taxes are due if the items

2. Click on Consumer Use Tax.

purchased are used, stored or consumed in these districts. RTA

3. Read the information on the page. Then click Next.

consumer use taxes are reported on form DR 0251.

4. Follow the steps and file your return.

Refer to the Colorado Sales/Use Tax Rates, form DR 1002

5. Once you have submitted your return, click the red

for special district boundaries and tax rates applicable to

Make a Payment button.

consumer use tax.

6. Select the payment type, and follow the steps to

Tax Paid Line 2a

make your payment.

If you paid state sales tax but not RTD/CD on certain

Note: For returns filed in Revenue Online, applicable RTA

purchases (or vice versa), enter the amount of those

consumer use taxes are included with the electronic return

purchases on line 2a in the appropriate column.

and a separate DR 0251 is not required.

Tax Credit Line 4

If you cannot file through Revenue Online, complete this

With proof of payment, sales tax paid to another state

return in its entirety and mail with payment to:

may be credited against state use tax due in Colorado

Colorado Department of Revenue

for a particular item. The credit is limited to the amount of

Denver, CO 80261-0013

Colorado state use tax due on the transaction. The credit

Retain a copy of this return for your records.

should be first applied to the state tax; any unused credit

should be prorated among the remaining use taxes.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4