Form T2200 - Declaration Of Conditions Of Employment

ADVERTISEMENT

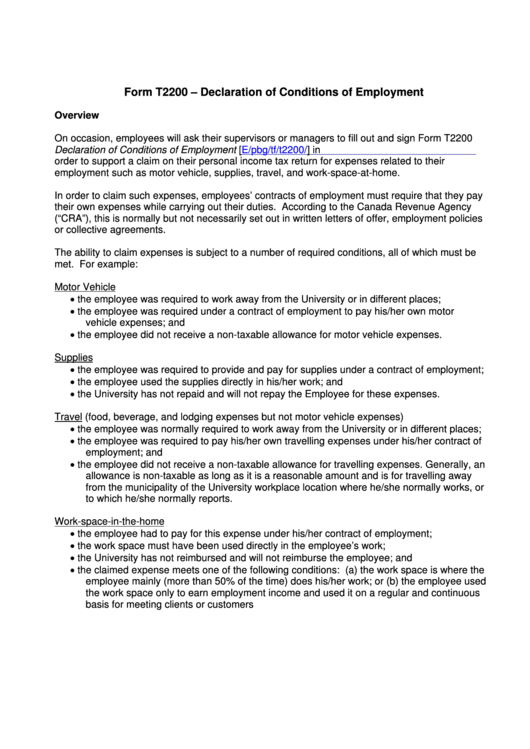

Form T2200 – Declaration of Conditions of Employment

Overview

On occasion, employees will ask their supervisors or managers to fill out and sign Form T2200

Declaration of Conditions of Employment [ in

order to support a claim on their personal income tax return for expenses related to their

employment such as motor vehicle, supplies, travel, and work-space-at-home.

In order to claim such expenses, employees’ contracts of employment must require that they pay

their own expenses while carrying out their duties. According to the Canada Revenue Agency

(“CRA”), this is normally but not necessarily set out in written letters of offer, employment policies

or collective agreements.

The ability to claim expenses is subject to a number of required conditions, all of which must be

met. For example:

Motor Vehicle

•

the employee was required to work away from the University or in different places;

•

the employee was required under a contract of employment to pay his/her own motor

vehicle expenses; and

•

the employee did not receive a non-taxable allowance for motor vehicle expenses.

Supplies

•

the employee was required to provide and pay for supplies under a contract of employment;

•

the employee used the supplies directly in his/her work; and

•

the University has not repaid and will not repay the Employee for these expenses.

Travel (food, beverage, and lodging expenses but not motor vehicle expenses)

•

the employee was normally required to work away from the University or in different places;

•

the employee was required to pay his/her own travelling expenses under his/her contract of

employment; and

•

the employee did not receive a non-taxable allowance for travelling expenses. Generally, an

allowance is non-taxable as long as it is a reasonable amount and is for travelling away

from the municipality of the University workplace location where he/she normally works, or

to which he/she normally reports.

Work-space-in-the-home

•

the employee had to pay for this expense under his/her contract of employment;

•

the work space must have been used directly in the employee’s work;

•

the University has not reimbursed and will not reimburse the employee; and

•

the claimed expense meets one of the following conditions: (a) the work space is where the

employee mainly (more than 50% of the time) does his/her work; or (b) the employee used

the work space only to earn employment income and used it on a regular and continuous

basis for meeting clients or customers

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3