(CONTINUED)

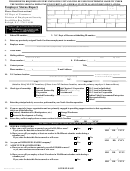

NATURE OF BUSINESS: Information is required on all items. Attach additional sheets, if necessary.

A. How many Georgia locations do you operate?

Enter in order of importance and indicate

C.

approximate % of total annual income derived

Provide the following information for each location, attaching additional

from each:

sheets if necessary.

B. Check the box that best describes the industry that relates to your

Principal Service(s)

Principal Product(s)

OR

Mfg.

Grown

Sold

Rendered*

business activities:

Manufacturing

%

Agriculture

Transportation

Forestry

%

Communication

Fishing

%

Public Utilities

* If Transportation-Trucking, indicate if interstate carrier

Mining

Wholesale Trade

D. If this report includes establishment(s) that only

Construction (specify):

Retail Trade

perform services for other units of the company,

General Contractors Industrial___%

Finance

indicate the primary type of service or support

Residential___% Commercial___%

Insurance

provided. Check as many as apply:

Speculative Building

Real Estate

Special Trade Contractor (specify plumbing,

1.

Central Administration 3.

Storage (warehouse)

Services

etc.,)_________________

2.

Research,development, 4.

Other: (specify),

Public Administration

Heavy Construction (specify cable, highway,

and testing

Private Household

etc.,)_________________

Employer

FOR ASSISTANCE, call the Industry Classification Unit, (404) 232-3875

IMPORTANT - This report must be filed! The law provides that all employing units shall file a report of its employment during a calendar year. For the

purpose of aiding you in complying with OCGA Section 34-8-121 of the Employment

Security Law, this form has

been prepared to

assist you in

furnishing the required information. Answer all questions fully and if additional space is necessary under any item, attach signed and dated sheets which

bear the words "Supplement to Form DOL-1N."

Each false statement or willful failure to furnish this report is punishable as a crime. Each day of such failure or refusal constitutes a separate

offense.

The Georgia Employer Status Report is required of all employers having individuals performing services in Georgia regardless of number or duration of

time.

The filing of this form is required at the time your business first had individuals performing service in Georgia, or when you acquired another legal entity,

and may also be required again upon request.

NOTE: Disclosure of your social security number is mandatory. It will be used for the purpose of identification and it is required under the

authorityof42U.S.C.Section405(c)(2)(C)andOCGASection 34-8-121.

INSTRUCTIONS

(NUMBERS CORRESPOND TO ITEMS ON FORM)

Enter or correct name and address of individual owner, partners, corporation or organization. This is the address to which you authorize us to

1.

mail all reports, correspondence, etc. If you have already been assigned a Georgia Department of Labor Account Number (Ga. DOL Acct. No) by

this Department, please insert the number.

Indicate by check mark type of organization. If a nonprofit organization, attach copy of I.R.S. letter exempting the organization from Federal

2.

Income Tax under Section 501(c)(3) of Internal Revenue Code.

3. Trade name by which business is known if different than 1.

4. Physical location of business, farm or household in Georgia if different than 1. Please include telephone number with area code.

5.

Enter the first date of employment in Georgia and the first date of Georgia payroll.

If you are subject to the Federal Unemployment Tax Act, and are required to file Federal Form 940, answer this question "yes". Be sure to enter

6.

your Federal Employer Identification Number whether answered "yes" or "no".

7. Answer this question if you acquired this business from another employer or if after you began employing workers you have acquired other

businesses; merged with other businesses; formed or dissolved partnerships, corporations, professional associations; or if any other change in

the ownership of the business has occurred. Indicate the date of acquisition or change and provide all information concerning the previous

owner's name, trade name, address and DOL Account Number. Indicate by checking the appropriate block the portion of the previous owner's

business involved in the acquisition or change. No transfer of experience rating history can be made unless information concerning the previous

owner is provided.

8.

Private Business Employment - Most employment is considered private business employment. This includes all types of work except domestic

service such as maids, gardeners, cooks, etc., agricultural service and service performed for governmental or nonprofit organizations.

Domestic employment includes all service for a person in the operation and maintenance of a private household, local college club or local

9.

chapter of a college fraternity or sorority such as chauffeurs, cooks, babysitters, gardeners, maids, butlers, private and/or social secretaries,

etc. If you had such employment, consider only cash payments made to all individuals performing domestic services to determine if $1,000 or

more cash wages were paid in any calendar quarter during 1977 and subsequent quarters.

10. Consider only cash payments made to all individuals performing agricultural services to determine if $20,000 or more cash wages were paid in

any calendar quarter during 1977 and subsequent quarters.

Answer this question only if this business is a nonprofit organization exempt from Federal Income Tax under Section 501(c)(3) of the Internal

11.

Revenue Code. Attach a copy of the I.R.S. letter granting this exemption. Nonprofit organizations with tax exemptions other than under Section

501 (c)(3) should answer question 8, Private Business Employment.

12. Self-explanatory.

FOR ASSISTANCE, call the Adjudication Section, (404) 232-3301

RETURN ORIGINAL WITHIN TEN (10) DAYS TO:

OR

FAX TO:

Georgia Department of Labor

Adjudication Section

P O Box 740234

404-232-3285

Atlanta, GA 30374-0234

Print

Clear

Save

Please RETAIN a copy for your files.

1

1 2

2