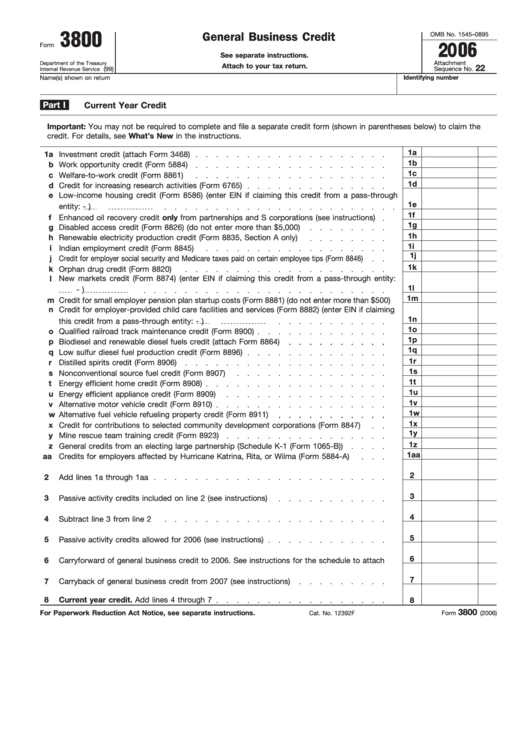

3800

OMB No. 1545–0895

General Business Credit

Form

2006

See separate instructions.

Attachment

Department of the Treasury

Attach to your tax return.

22

(99)

Sequence No.

Internal Revenue Service

Name(s) shown on return

Identifying number

Part I

Current Year Credit

Important: You may not be required to complete and file a separate credit form (shown in parentheses below) to claim the

credit. For details, see What’s New in the instructions.

1a

1a

Investment credit (attach Form 3468)

1b

b

Work opportunity credit (Form 5884)

1c

c

Welfare-to-work credit (Form 8861)

1d

d

Credit for increasing research activities (Form 6765)

e

Low-income housing credit (Form 8586) (enter EIN if claiming this credit from a pass-through

1e

entity:

-

)

1f

f

Enhanced oil recovery credit only from partnerships and S corporations (see instructions)

1g

g

Disabled access credit (Form 8826) (do not enter more than $5,000)

1h

h

Renewable electricity production credit (Form 8835, Section A only)

1i

i

Indian employment credit (Form 8845)

1j

Credit for employer social security and Medicare taxes paid on certain employee tips (Form 8846)

j

1k

k

Orphan drug credit (Form 8820)

New markets credit (Form 8874) (enter EIN if claiming this credit from a pass-through entity:

l

1l

-

)

1m

m

Credit for small employer pension plan startup costs (Form 8881) (do not enter more than $500)

n

Credit for employer-provided child care facilities and services (Form 8882) (enter EIN if claiming

1n

this credit from a pass-through entity:

-

)

1o

o

Qualified railroad track maintenance credit (Form 8900)

1p

p

Biodiesel and renewable diesel fuels credit (attach Form 8864)

1q

q

Low sulfur diesel fuel production credit (Form 8896)

1r

r

Distilled spirits credit (Form 8906)

1s

s Nonconventional source fuel credit (Form 8907)

1t

t Energy efficient home credit (Form 8908)

1u

u

Energy efficient appliance credit (Form 8909)

1v

v

Alternative motor vehicle credit (Form 8910)

1w

w

Alternative fuel vehicle refueling property credit (Form 8911)

1x

x

Credit for contributions to selected community development corporations (Form 8847)

1y

y

Mine rescue team training credit (Form 8923)

1z

z

General credits from an electing large partnership (Schedule K-1 (Form 1065-B))

1aa

aa

Credits for employers affected by Hurricane Katrina, Rita, or Wilma (Form 5884-A)

2

2

Add lines 1a through 1aa

3

3

Passive activity credits included on line 2 (see instructions)

4

4

Subtract line 3 from line 2

5

5

Passive activity credits allowed for 2006 (see instructions)

6

6

Carryforward of general business credit to 2006. See instructions for the schedule to attach

7

7

Carryback of general business credit from 2007 (see instructions)

8

Current year credit. Add lines 4 through 7

8

3800

For Paperwork Reduction Act Notice, see separate instructions.

Cat. No. 12392F

Form

(2006)

1

1 2

2