Colored Fuel Certification

ADVERTISEMENT

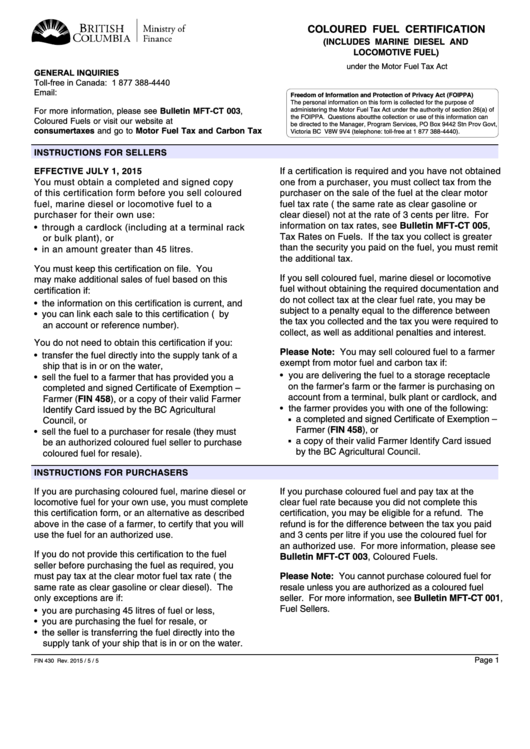

CoLoUrEd FUEL CErTIFICATIoN

(INCLUdEs MArINE dIEsEL ANd

LoCoMoTIVE FUEL)

under the Motor Fuel Tax Act

General InquIrIes

Toll-free in Canada: 1 877 388-4440

Email: FuelTax@gov.bc.ca

Freedom of Information and Protection of Privacy Act (FOIPPA)

The personal information on this form is collected for the purpose of

For more information, please see Bulletin MFT-CT 003,

administering the Motor Fuel Tax Act under the authority of section 26(a) of

the FOIPPA. Questions about the collection or use of this information can

Coloured Fuels or visit our website at

be directed to the Manager, Program Services, PO Box 9442 Stn Prov Govt,

consumertaxes and go to Motor Fuel Tax and Carbon Tax

Victoria BC V8W 9V4 (telephone: toll-free at 1 877 388-4440).

INsTrUCTIoNs For sELLErs

If a certification is required and you have not obtained

EFFECTIVE JULY 1, 2015

You must obtain a completed and signed copy

one from a purchaser, you must collect tax from the

of this certification form before you sell coloured

purchaser on the sale of the fuel at the clear motor

fuel, marine diesel or locomotive fuel to a

fuel tax rate (i.e. the same rate as clear gasoline or

purchaser for their own use:

clear diesel) not at the rate of 3 cents per litre. For

information on tax rates, see Bulletin MFT-CT 005,

• through a cardlock (including at a terminal rack

Tax Rates on Fuels. If the tax you collect is greater

or bulk plant), or

than the security you paid on the fuel, you must remit

• in an amount greater than 45 litres.

the additional tax.

You must keep this certification on file. You

If you sell coloured fuel, marine diesel or locomotive

may make additional sales of fuel based on this

fuel without obtaining the required documentation and

certification if:

do not collect tax at the clear fuel rate, you may be

• the information on this certification is current, and

subject to a penalty equal to the difference between

• you can link each sale to this certification (e.g. by

the tax you collected and the tax you were required to

an account or reference number).

collect, as well as additional penalties and interest.

You do not need to obtain this certification if you:

Please Note: You may sell coloured fuel to a farmer

• transfer the fuel directly into the supply tank of a

exempt from motor fuel and carbon tax if:

ship that is in or on the water,

• you are delivering the fuel to a storage receptacle

• sell the fuel to a farmer that has provided you a

on the farmer’s farm or the farmer is purchasing on

completed and signed Certificate of Exemption –

account from a terminal, bulk plant or cardlock, and

Farmer (FIN 458), or a copy of their valid Farmer

• the farmer provides you with one of the following:

Identify Card issued by the BC Agricultural

a completed and signed Certificate of Exemption –

Council, or

■

Farmer (FIN 458), or

• sell the fuel to a purchaser for resale (they must

a copy of their valid Farmer Identify Card issued

be an authorized coloured fuel seller to purchase

■

by the BC Agricultural Council.

coloured fuel for resale).

INsTrUCTIoNs For PUrCHAsErs

If you are purchasing coloured fuel, marine diesel or

If you purchase coloured fuel and pay tax at the

locomotive fuel for your own use, you must complete

clear fuel rate because you did not complete this

this certification form, or an alternative as described

certification, you may be eligible for a refund. The

above in the case of a farmer, to certify that you will

refund is for the difference between the tax you paid

use the fuel for an authorized use.

and 3 cents per litre if you use the coloured fuel for

an authorized use. For more information, please see

If you do not provide this certification to the fuel

Bulletin MFT-CT 003, Coloured Fuels.

seller before purchasing the fuel as required, you

Please Note: You cannot purchase coloured fuel for

must pay tax at the clear motor fuel tax rate (i.e. the

same rate as clear gasoline or clear diesel). The

resale unless you are authorized as a coloured fuel

only exceptions are if:

seller. For more information, see Bulletin MFT-CT 001,

Fuel Sellers.

• you are purchasing 45 litres of fuel or less,

• you are purchasing the fuel for resale, or

• the seller is transferring the fuel directly into the

supply tank of your ship that is in or on the water.

Page 1

FIN 430 Rev. 2015 / 5 / 5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2