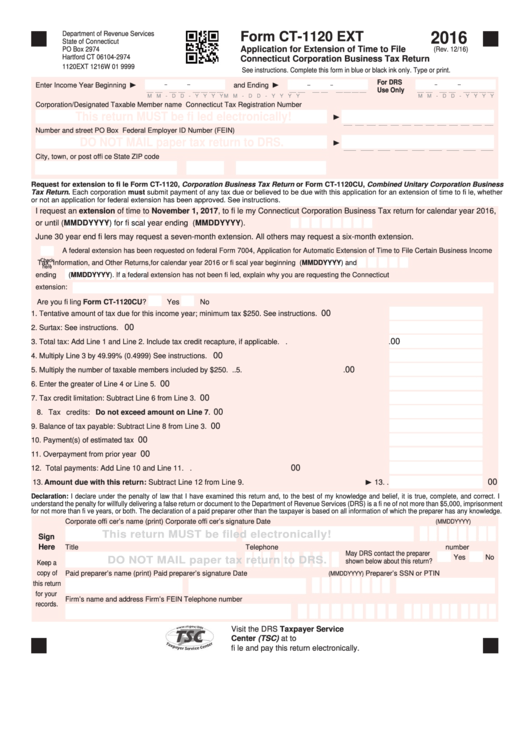

Form Ct-1120 Ext - Application For Extension Of Time To Fileconnecticut Corporation Business Tax Return - 2016

ADVERTISEMENT

Department of Revenue Services

Form CT-1120 EXT

2016

State of Connecticut

Application for Extension of Time to File

PO Box 2974

(Rev. 12/16)

Hartford CT 06104-2974

Connecticut Corporation Business Tax Return

1120EXT 1216W 01 9999

See instructions. Complete this form in blue or black ink only. Type or print.

For DRS

Enter Income Year Beginning

and Ending

Use Only

M M - D D - Y Y Y Y

M M - D D - Y Y Y Y

M M - D D - Y Y Y Y

Corporation/Designated Taxable Member name

Connecticut Tax Registration Number

This return MUST be fi led electronically!

Number and street

PO Box

Federal Employer ID Number (FEIN)

DO NOT MAIL paper tax return to DRS.

City, town, or post offi ce

State

ZIP code

Request for extension to fi le Form CT-1120, Corporation Business Tax Return or Form CT-1120CU, Combined Unitary Corporation Business

Tax Return. Each corporation must submit payment of any tax due or believed to be due with this application for an extension of time to fi le, whether

or not an application for federal extension has been approved. See instructions.

I request an extension of time to November 1, 2017, to fi le my Connecticut Corporation Business Tax return for calendar year 2016,

or until

(MMDDYYYY) for fi scal year ending

(MMDDYYYY).

June 30 year end fi lers may request a seven-month extension. All others may request a six-month extension.

A federal extension has been requested on federal Form 7004, Application for Automatic Extension of Time to File Certain Business Income

Check

Tax, Information, and Other Returns, for calendar year 2016 or fi scal year beginning

(MMDDYYYY) and

here

ending

(MMDDYYYY). If a federal extension has not been fi led, explain why you are requesting the Connecticut

extension:

Are you fi ling Form CT-1120CU?

Yes

No

00

1. Tentative amount of tax due for this income year; minimum tax $250. See instructions. ........................ 1.

.

00

2. Surtax: See instructions. ......................................................................................................................... 2.

.

00

3. Total tax: Add Line 1 and Line 2. Include tax credit recapture, if applicable. .......................................... 3.

.

00

4. Multiply Line 3 by 49.99% (0.4999) See instructions. ............................................................................. 4.

.

00

5. Multiply the number of taxable members included by $250. .................................................................... 5.

.

00

6. Enter the greater of Line 4 or Line 5. ....................................................................................................... 6.

.

00

7. Tax credit limitation: Subtract Line 6 from Line 3. .................................................................................... 7.

.

00

8. Tax credits: Do not exceed amount on Line 7. ..................................................................................... 8.

.

00

9. Balance of tax payable: Subtract Line 8 from Line 3. .............................................................................. 9.

.

00

10. Payment(s) of estimated tax .................................................................................................................. 10.

.

00

11. Overpayment from prior year ..................................................................................................................11.

.

00

12. Total payments: Add Line 10 and Line 11. .......................................................................................... 12.

.

00

13. Amount due with this return: Subtract Line 12 from Line 9. .........................................................

13.

.

Declaration: I declare under the penalty of law that I have examined this return and, to the best of my knowledge and belief, it is true, complete, and correct. I

understand the penalty for willfully delivering a false return or document to the Department of Revenue Services (DRS) is a fi ne of not more than $5,000, imprisonment

for not more than fi ve years, or both. The declaration of a paid preparer other than the taxpayer is based on all information of which the preparer has any knowledge.

Corporate offi cer’s name (print)

Corporate offi cer’s signature

Date

(MMDDYYYY)

This return MUST be filed electronically!

Sign

Here

Title

Telephone number

May DRS contact the preparer

Yes

No

DO NOT MAIL paper tax return to DRS.

shown below about this return?

Keep a

copy of

Paid preparer’s name (print)

Paid preparer’s signature

Date

Preparer’s SSN or PTIN

(MMDDYYYY)

this return

for your

Firm’s name and address

Firm’s FEIN

Telephone number

records.

Visit the DRS Taxpayer Service

Center (TSC) at to

fi le and pay this return electronically.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3