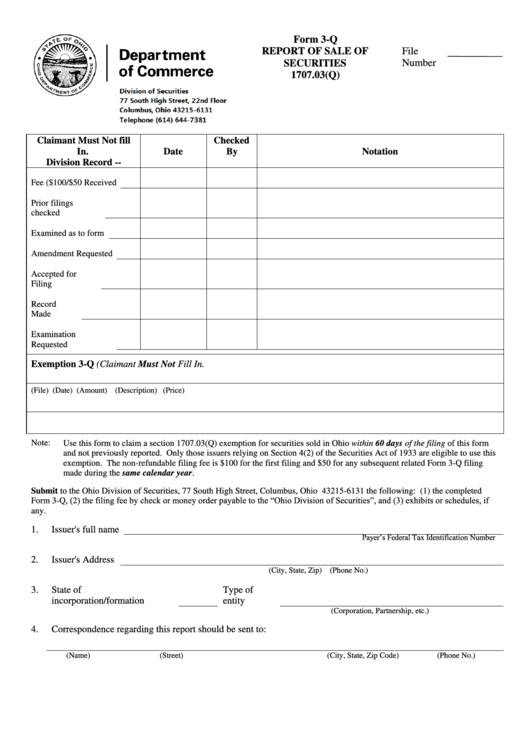

Form 3-Q - Report Of Sale Of Securities

ADVERTISEMENT

Form 3-Q

REPORT OF SALE OF

File

SECURITIES

Number

1707.03(Q)

Claimant Must Not fill

Checked

In.

Date

By

Notation

Division Record --

Fee ($100/$50 Received

Prior filings

checked

Examined as to form

Amendment Requested

Accepted for

Filing

Record

Made

Examination

Requested

Exemption 3-Q (Claimant Must Not Fill In.

(File)

(Date)

(Amount)

(Description)

(Price)

Note:

Use this form to claim a section 1707.03(Q) exemption for securities sold in Ohio within 60 days of the filing of this form

and not previously reported. Only those issuers relying on Section 4(2) of the Securities Act of 1933 are eligible to use this

exemption. The non-refundable filing fee is $100 for the first filing and $50 for any subsequent related Form 3-Q filing

made during the same calendar year.

Submit to the Ohio Division of Securities, 77 South High Street, Columbus, Ohio 43215-6131 the following: (1) the completed

Form 3-Q, (2) the filing fee by check or money order payable to the “Ohio Division of Securities”, and (3) exhibits or schedules, if

any.

1.

Issuer's full name

Payer’s Federal Tax Identification Number

2.

Issuer's Address

(City, State, Zip)

(Phone No.)

3.

State

of

Type of

incorporation/formation

entity

(Corporation, Partnership, etc.)

4.

Correspondence regarding this report should be sent to:

(Name)

(Street)

(City, State, Zip Code)

(Phone No.)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3