Hsa Enrollment Form Page 2

ADVERTISEMENT

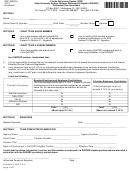

Debit Card Information

Note: You may request a debit card for yourself, for an authorized signer, and/or for Dependent(s). A total of two (2) debit cards are available at no charge for each HSA.

There is a charge of $10.00 for each additional card after the first two (2). Debit card holders must be at least 18 years of age.

Would you like to receive a free HSA Debit MasterCard® for your account?

Yes

No

Would you like a free Debit MasterCard® issued to your Authorized Signer listed above (if applicable)?

Yes

No

Direct Deposit Setup Information

Complete the information below to link a bank account to your HSA. The account can be used to make electronic contributions to your HSA or to receive electronic

withdrawals from your HSA.

Financial Institution Name

Financial Institution Street Address

City

State

Zip Code

Account Type:

Checking

Savings

Routing Number

Account Number

R

o

u

t

i

n

g

N

u

m

b

e

r

A

c

c

o

u

n

t

N

u

m

b

e

r

R

o

u

t

i

n

g

N

u

m

b

e

r

A

c

c

o

u

n

t

N

u

m

b

e

r

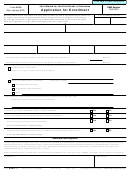

Beneficiary Designation Information

The following individual(s) or entity shall be my primary and/or contingent death beneficiary(ies). If neither primary nor contingent is indicated, the individual or entity will be

deemed to be a primary death beneficiary. If more than one primary death beneficiary is designated, the death beneficiaries will be deemed to own equal share percentages in

the HSA. Multiple contingent death beneficiaries will also be deemed to share equally.

If any primary or contingent death beneficiary dies before I do, his or her interest and the interest of his or her heirs shall terminate completely, and the percentage share of

any remaining death beneficiary(ies) shall be increased on a pro rata basis. If no primary death beneficiary(ies) survives me, the contingent death beneficiary(ies) shall

acquire the designated share of my HSA.

If no Beneficiary is named, or if all Beneficiaries pre-decease the owner, the HSA funds will be paid to the estate.

Social Security

Primary or

Share

No.

Name and Address

Date of Birth

Relationship

Number

Contingent

%

1.

Primary

Spouse

Contingent

Dependent

Other

2.

Primary

Spouse

Contingent

Dependent

Other

3.

Primary

Spouse

Contingent

Dependent

Other

Spousal Consent

This section should be reviewed if either the trust or the residence of the HSA Account Beneficiary is located in a community or marital property state (Arizona, California,

Idaho, Louisiana, Nevada, New Mexico, Texas, Washington and Wisconsin) and the HSA Account Beneficiary is married. Due to the important tax consequences of giving up

one’s community property interest, individuals signing this section should consult with a competent tax or legal advisor.

I am not married and I understand that if I become married in the future, I must complete a new HSA Designation of Death Beneficiary form.

I am married and I understand that if I choose to designate a primary death beneficiary other than my spouse, my spouse must sign below.

I am the spouse of the above-named HSA Account Beneficiary. I acknowledge that I have received a fair and reasonable disclosure of my spouse’s property and financial

obligations. Due to the important tax consequences of giving up my interest in this HSA, I have been advised to see a tax professional.

I hereby give the HSA Account Beneficiary any interest I have in the funds or property deposited in this HSA and consent to the death beneficiary designation(s) indicated above. I

assume full responsibility for any adverse consequences that may result. No tax or legal advice was given to me by the Custodian.

Signature of Spouse

Date

Signature of Witness

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3