Beneficiary Designation Form

Download a blank fillable Beneficiary Designation Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Beneficiary Designation Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

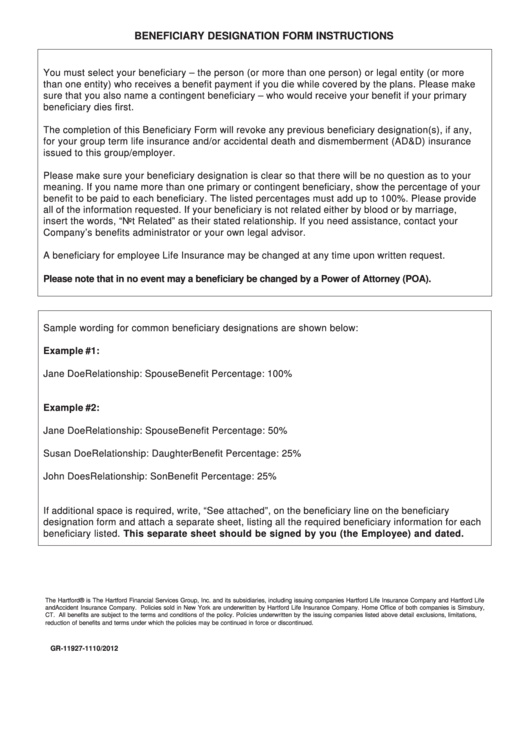

BENEFICIARY DESIGNATION FORM INSTRUCTIONS

You must select your beneficiary – the person (or more than one person) or legal entity (or more

than one entity) who receives a benefit payment if you die while covered by the plans. Please make

sure that you also name a contingent beneficiary – who would receive your benefit if your primary

beneficiary dies first.

The completion of this Beneficiary Form will revoke any previous beneficiary designation(s), if any,

for your group term life insurance and/or accidental death and dismemberment (AD&D) insurance

issued to this group/employer.

Please make sure your beneficiary designation is clear so that there will be no question as to your

meaning. If you name more than one primary or contingent beneficiary, show the percentage of your

benefit to be paid to each beneficiary. The listed percentages must add up to 100%. Please provide

all of the information requested. If your beneficiary is not related either by blood or by marriage,

insert the words, “Not Related” as their stated relationship. If you need assistance, contact your

Company’s benefits administrator or your own legal advisor.

A beneficiary for employee Life Insurance may be changed at any time upon written request.

Please note that in no event may a beneficiary be changed by a Power of Attorney (POA).

Sample wording for common beneficiary designations are shown below:

Example #1:

Jane Doe

Relationship: Spouse

Benefit Percentage: 100%

Example #2:

Jane Doe

Relationship: Spouse

Benefit Percentage: 50%

Susan Doe

Relationship: Daughter

Benefit Percentage: 25%

John Does

Relationship: Son

Benefit Percentage: 25%

If additional space is required, write, “See attached”, on the beneficiary line on the beneficiary

designation form and attach a separate sheet, listing all the required beneficiary information for each

beneficiary listed. This separate sheet should be signed by you (the Employee) and dated.

The Hartford® is The Hartford Financial Services Group, Inc. and its subsidiaries, including issuing companies Hartford Life Insurance Company and Hartford Life

andAccident Insurance Company. Policies sold in New York are underwritten by Hartford Life Insurance Company. Home Office of both companies is Simsbury,

CT. All benefits are subject to the terms and conditions of the policy. Policies underwritten by the issuing companies listed above detail exclusions, limitations,

reduction of benefits and terms under which the policies may be continued in force or discontinued.

GR-11927-11

10/2012

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2