Net Profit Income Tax Form 27 Instruction Booklet - 2016

ADVERTISEMENT

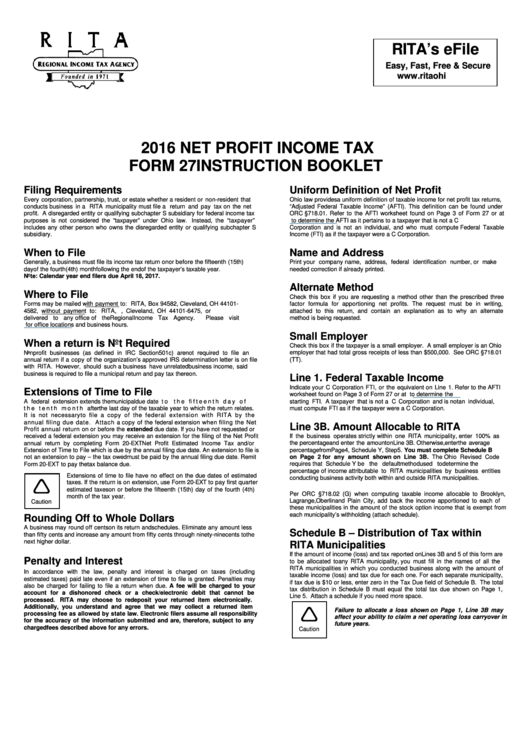

RITA’s eFile

Easy, Fast, Free & Secure

2016 NET PROFIT INCOME TAX

FORM 27 INSTRUCTION BOOKLET

Filing Requirements

Uniform Definition of Net Profit

Every corporation, partnership, trust, or estate whether a resident or non-resident that

Ohio law provides a uniform definition of taxable income for net profit tax returns,

conducts business in a RITA municipality must file a return and pay tax on the net

“Adjusted Federal Taxable Income” (AFTI). This definition can be found under

profit. A disregarded entity or qualifying subchapter S subsidiary for federal income tax

ORC §718.01. Refer to the AFTI worksheet found on Page 3 of Form 27 or at

purposes is not considered the “taxpayer” under Ohio law. Instead, the “taxpayer”

to determine the AFTI as it pertains to a taxpayer that is not a C

includes any other person who owns the disregarded entity or qualifying subchapter S

Corporation and is not an individual, and who must compute Federal Taxable

subsidiary.

Income (FTI) as if the taxpayer were a C Corporation.

When to File

Name and Address

Generally, a business must file its income tax return on or before the fifteenth (15th)

Print your company name, address, federal identification number, or make

day of the fourth (4th) month following the end of the taxpayer’s taxable year.

needed correction if already printed.

Note: Calendar year end filers due April 18, 2017.

Alternate Method

Where to File

Check this box if you are requesting a method other than the prescribed three

Forms may be mailed with payment to: RITA, P.O. Box 94582, Cleveland, OH 44101-

factor formula for apportioning net profits. The request must be in writing,

4582, without payment to:

RITA, P.O. Box 89475, Cleveland, OH 44101-6475, or

attached to this return, and contain an explanation as to why an alternate

delivered to any office of the Regional Income Tax Agency.

Please visit

method is being requested.

for office locations and business hours.

Small Employer

When a return is Not Required

Check this box if the taxpayer is a small employer. A small employer is an Ohio

employer that had total gross receipts of less than $500,000. See ORC §718.01

Nonprofit businesses (as defined in IRC Section 501c) are not required to file an

annual return if a copy of the organization’s approved IRS determination letter is on file

(TT).

with RITA. However, should such a business have unrelated business income, said

business is required to file a municipal return and pay tax thereon.

Line 1. Federal Taxable Income

Indicate your C Corporation FTI, or the equivalent on Line 1. Refer to the AFTI

Extensions of Time to File

worksheet found on Page 3 of Form 27 or at

to determine the

starting FTI. A taxpayer that is not a C Corporation and is not an individual,

A federal extension extends the municipal due date t o t h e f i f t e e n t h d a y o f

t h e t e n t h m o n t h after the last day of the taxable year to which the return relates.

must compute FTI as if the taxpayer were a C Corporation.

It is not necessary to file a copy of the federal extension with RITA by the

annual filing due date. Attach a copy of the federal extension when filing the Net

Line 3B. Amount Allocable to RITA

Profit annual return on or before the extended due date. If you have not requested or

If the business operates strictly within one RITA municipality, enter 100% as

received a federal extension you may receive an extension for the filing of the Net Profit

annual return by completing Form 20-EXT Net Profit Estimated Income Tax and/or

the percentage and enter the amount on Line 3B. Otherwise, enter the average

percentage from Page 4, Schedule Y, Step 5. You must complete Schedule B

Extension of Time to File which is due by the annual filing due date. An extension to file is

not an extension to pay – the tax owed must be paid by the annual filing due date. Remit

on Page 2 for any amount shown on Line 3B. The Ohio Revised Code

Form 20-EXT to pay the tax balance due.

requires that Schedule Y be the default method used to determine the

percentage of income attributable to RITA municipalities by business entities

Extensions of time to file have no effect on the due dates of estimated

conducting business activity both within and outside RITA municipalities.

taxes. If the return is on extension, use Form 20-EXT to pay first quarter

estimated taxes on or before the fifteenth (15th) day of the fourth (4th)

Per ORC §718.02 (G) when computing taxable income allocable to Brooklyn,

month of the tax year.

Lagrange, Oberlin and Plain City, add back the income apportioned to each of

Caution

these municipalities in the amount of the stock option income that is exempt from

each municipality’s withholding (attach schedule).

Rounding Off to Whole Dollars

A business may round off cents on its return and schedules. Eliminate any amount less

Schedule B – Distribution of Tax within

than fifty cents and increase any amount from fifty cents through ninety-nine cents to the

next higher dollar.

RITA Municipalities

If the amount of income (loss) and tax reported on Lines 3B and 5 of this form are

Penalty and Interest

to be allocated to any RITA municipality, you must fill in the names of all the

RITA municipalities in which you conducted business along with the amount of

In accordance with the law, penalty and interest is charged on taxes (including

taxable income (loss) and tax due for each one. For each separate municipality,

estimated taxes) paid late even if an extension of time to file is granted. Penalties may

if tax due is $10 or less, enter zero in the Tax Due field of Schedule B. The total

also be charged for failing to file a return when due. A fee will be charged to your

tax distribution in Schedule B must equal the total tax due shown on Page 1,

account for a dishonored check or a check/electronic debit that cannot be

Line 5. Attach a schedule if you need more space.

processed.

RITA may choose to redeposit your returned item electronically.

Additionally, you understand and agree that we may collect a returned item

Failure to allocate a loss shown on Page 1, Line 3B may

processing fee as allowed by state law. Electronic filers assume all responsibility

affect your ability to claim a net operating loss carryover in

for the accuracy of the information submitted and are, therefore, subject to any

future years.

charged fees described above for any errors.

Caution

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3