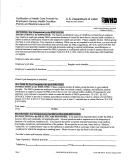

SUBMITTING YOUR CLAIM & PREPARING YOUR CLAIM FORM

-

Retain copies for your files. Claim information cannot be returned.

-

Do not highlight the form or enclosed documentation. Highlighting makes scanned and faxed documents difficult to read.

-

Refer to

w

for additional claim tips. Once in Navigator, click on the

C laims & Balances

link and then

H U

U H

U

U

click on

C laims

. On the left side of the screen, click on

F orm

s . Scroll down to Flexible Spending Account (FSA) and scroll to

U

U

U

U

the Reimbursement section. Click on the link for

H ealth Care and Dependent Care claim submission guidelines

.

U

U

SECTION 1 – Employee Information

FSA Identification Number – As a participant with the FSA, you have been assigned a unique participant number. Your FSA ID

Number is a 9 digit number preceded with a “W”. If you do not know your W#, you can locate it from any one of the following sources:

•

E xplanation of Payment (EOP)

– Paper EOPs always display your W#.

U

U

•

A ctivity Statement

– As an Aetna FSA participant you may receive an activity statement at least once a year; refer to this

U

U

statement for your W#.

•

A etna Medical ID Card

– If you have Aetna medical coverage, the W# displayed on your ID card is also used for your FSA.

U

U

•

M ember Services

– Call FSA Member Services to inquire about your W#.

U

U

N OTE

: If you prefer, you can use your Social Security Number in this field.

U

U

Employee’s Address – Report an address change to your employer. To avoid misdirected claim payments, your employer must notify

Aetna of your new address.

SECTION 2 – Employer Information

FSA Control Number – Your employer has been assigned a unique FSA plan number. If this form does not have that number pre-

printed, you can locate this number from any one of the sources (with the exception of the Aetna Medical ID card) listed in Section 1.

SECTION 3 – Expense Information

While meeting the deductible of your High Deductible Health Plan (HDHP), the Limited FSA (LFSA) can only reimburse for

qualified out-of-pocket dental, vision and preventive care expenses, including preventive prescription medications and over-

the counter dental, vision and preventive care items. Once you have met your HDHP deductible, the LFSA can reimburse for these

expenses as well as all other qualified medical expenses that have been incurred after meeting the deductible. List and separate

expenses by individual family members. Attach the appropriate documentation for each claim.

N ote

: A canceled check is not

U

U

adequate documentation.

I f you have insurance that covers part of this expense or

F or a prescription claim or if you do not have insurance

:

U

U

U

your insurance does not cover this expense at all:

Submit the itemized receipt or statement from the

Submit the Explanation of Benefits (EOB) with your

doctor/dentist/ pharmacist/health care professional. This

completed claim form. You do not need to submit any other

itemized receipt or statement must include:

documentation with the EOB. For a prescription drug claim,

Name & address of doctor/dentist/pharmacist/health

refer to the instructions to the right.

care professional

N OTE

: Any third party documentation that indicates

Patient’s name

U

U

insurance has not yet paid (e.g., pre-treatment estimate) will

Date(s) of service

be returned to you. You will need to resubmit the claim

Type of service or prescription name

once you have received a final EOB; the EOB must show

Dollar amount charged

that the insurance carrier has paid its portion of the claim.

N OTE

: This receipt must clearly document patient’s financial

U

U

responsibility.

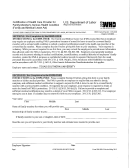

SECTION 4 – Orthodontia Expenses

For Orthodontia claims, please follow these guidelines.

•

When submitting your first orthodontia claim, you must submit the orthodontia contract from the orthodontist along with a

signed Flexible Spending Account Health Care Reimbursement form. This contract must indicate

i nitial fee charged

,

e stimated

U

U

U

insurance payment

,

i nitial start date

,

d uration of treatment

and

p roof of partial or full down payment

.

U

U

U

U

U

U

U

•

For each monthly request for reimbursement, you must submit a completed and signed claim form with an itemized

bill/statement or receipt from the orthodontist. This statement must show the monthly charge consistent with the original

orthodontic contract.

•

Future dates of services cannot be submitted. IRS guidelines require services to be incurred before you can be reimbursed. A

reimbursement request for a service that will occur in a subsequent plan year will be returned to you for resubmission in that

plan year.

SECTION 5 – Coordination of Benefits (COB)

When an expense is covered under more than one health plan, both EOBs must be submitted in order to process the reimbursement.

SECTION 6 – Deductible Status

Your EOB will substantiate if you have met your deductible.

SECTION 7 – Employee Certification

Y ou must sign and date this form to avoid claim payment delays.

U

GC-11-4 (9-10)

1

1 2

2