Roth Ira Conversion Request Form - (Internal) Between Rmb Funds Individual Retirement Accounts

ADVERTISEMENT

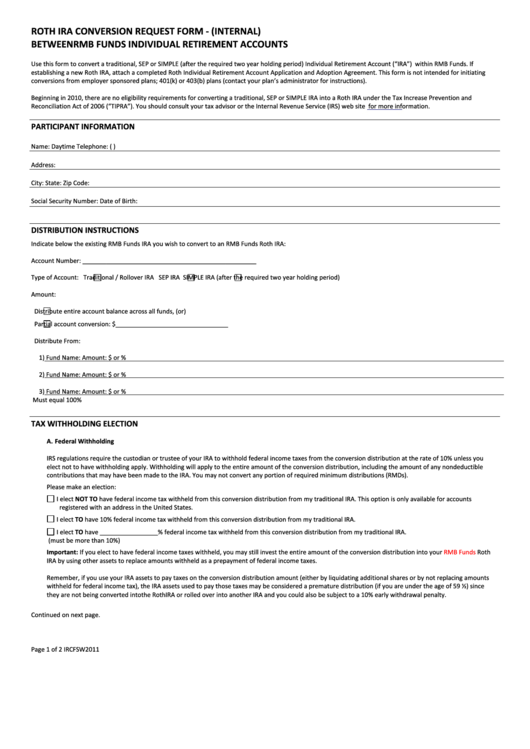

ROTH IRA CONVERSION REQUEST FORM - (INTERNAL)

BETWEEN RMB FUNDS INDIVIDUAL RETIREMENT ACCOUNTS

Use this form to convert a traditional, SEP or SIMPLE (after the required two year holding period) Individual Retirement Account (“IRA”) within RMB Funds. If

establishing a new Roth IRA, attach a completed Roth Individual Retirement Account Application and Adoption Agreement. This form is not intended for initiating

conversions from employer sponsored plans; 401(k) or 403(b) plans (contact your plan’s administrator for instructions).

Beginning in 2010, there are no eligibility requirements for converting a traditional, SEP or SIMPLE IRA into a Roth IRA under the Tax Increase Prevention and

Reconciliation Act of 2006 (“TIPRA”). You should consult your tax advisor or the Internal Revenue Service (IRS) web site

for more information.

PARTICIPANT INFORMATION

Name:

Daytime Telephone: (

)

Address:

City:

State:

Zip Code:

Social Security Number:

Date of Birth:

DISTRIBUTION INSTRUCTIONS

Indicate below the existing RMB Funds IRA you wish to convert to an RMB Funds Roth IRA:

Account Number: ___________________________________________________

Type of Account:

Traditional / Rollover IRA

SEP IRA

SIMPLE IRA (after the required two year holding period)

Amount:

Distribute entire account balance across all funds, (or)

Partial account conversion: $_________________________________

Distribute From:

1) Fund Name:

Amount: $

or

%

2) Fund Name:

Amount: $

or

%

3) Fund Name:

Amount: $

or

%

Must equal 100%

TAX WITHHOLDING ELECTION

A. Federal Withholding

IRS regulations require the custodian or trustee of your IRA to withhold federal income taxes from the conversion distribution at the rate of 10% unless you

elect not to have withholding apply. Withholding will apply to the entire amount of the conversion distribution, including the amount of any nondeductible

contributions that may have been made to the IRA. You may not convert any portion of required minimum distributions (RMDs).

Please make an election:

I elect NOT TO have federal income tax withheld from this conversion distribution from my traditional IRA. This option is only available for accounts

registered with an address in the United States.

I elect TO have 10% federal income tax withheld from this conversion distribution from my traditional IRA.

I elect TO have _________________% federal income tax withheld from this conversion distribution from my traditional IRA.

(must be more than 10%)

Important: If you elect to have federal income taxes withheld, you may still invest the entire amount of the conversion distribution into your

RMB Funds

Roth

IRA by using other assets to replace amounts withheld as a prepayment of federal income taxes.

Remember, if you use your IRA assets to pay taxes on the conversion distribution amount (either by liquidating additional shares or by not replacing amounts

withheld for federal income tax), the IRA assets used to pay those taxes may be considered a premature distribution (if you are under the age of 59 ½) since

they are not being converted into the Roth IRA or rolled over into another IRA and you could also be subject to a 10% early withdrawal penalty.

Continued on next page.

Page 1 of 2

IRCFSW2011

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2