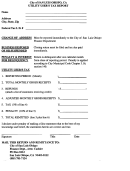

Utility User'S Tax Exemption/electric & Water Lifeline Rate Application Page 2

ADVERTISEMENT

Certification

(Please read carefully)

1. I am a user of the utilities at my residential service address within the City of Los Angeles and am responsible for the payment of

such utility bills which are all under my name;

2. I am either a:

a. Senior Citizen - 62 years of age or older, or a

b. Disabled Citizen - an individual shall be considered to be disabled if he or she is unable to engage in any substantial gainful

activity by reason of any medically determinable physical or mental impairment which can be expected to result in death or to be

of long-continued and indefinite duration.

3. The combined adjusted gross income (as used for purposes of the California Personal Income Tax Law) of all members of the

household in which I reside is less than $32,600 for the prior calendar year;

4. The amount of tax imposed on the above utilities is not paid by a public agency or from funds received from a public agency

specifically for the payment of such tax.

PLEASE FOLLOW ALL INSTRUCTIONS BELOW AS INCOMPLETE APPLICATIONS WILL NOT BE PROCESSED:

(To shorten the processing time of your application, please submit all of the following required documentation that applies to you, as a

Senior or Disabled Citizen, along with this completed form and return to us immediately at the address indicated on the face of this form.)

IF YOU ARE A SENIOR CITIZEN, please submit:

1. Proof of Age - attach a copy of your California State Driver's License, Calif. State Identification Card, or other acceptable proof of age;

2. A copy of the entire City of Los Angeles Department of Water and Power (DWP) bill showing the applicant's name with the

current service address (please do not send the payment portion only).

3. A copy of the entire Gas bill showing the applicant's name with the current service address (please do not send the

payment portion only). If not applicable, please write "NONE."

4. A copy of the entire telephone bill (with the applicant's name, current service address, Los Angeles City Tax, and, if applicable, the

page showing the long distance carrier (please do not send the payment portion only). If not applicable, please write "NONE."

5. Proof of income for applicant and each household member (as you have indicated on the application form) - For the calendar year prior to the

fiscal year the exemption is applied for, please provide us a copy of the California Resident Income Tax Return Form 540, Social Security

Benefits Statement, award letter of the amount of SSI benefits received, award letter from General Relief, or Cal Works/AFDC (entire copy).

If none of the above are applicable, you must provide a NOTARIZED LETTER stating income. Note: We will not accept copies of checks from

any County, W-2, Statement of Earnings and Deductions [pay stub] or the Federal Income Tax Return Form 1040.

IF YOU ARE A DISABLED CITIZEN, please submit:

1. Proof of disability - a recent (within the last 2 years) certification signed by a licensed physician attesting that you are

physically and/or mentally disabled which can be expected to result in death or to be of long-continued and indefinite duration,

hence, unable to engage in substantial gainful employment,

AND

2. All of the required items under "Senior Citizen" (see above), except item number 1. Proof of Age.

Persons who qualify for the DWP portion of this program may qualify for a Solid Resources Fee discount. Eligibility will be reviewed on a bi-annual

basis. For new applicants, the DWP Lifeline Discount Rate will become effective the first full billing period after the approved application is received by

DWP. Existing customers will continue to enjoy the discounted rate as long as they maintain eligibility. Please notify the Office of Finance of any change

in information provided on this application. A new application must be completed within 90 days when there is a change of name or address in order to

maintain your exemption. A change of apartment in the same building is a change of address. If you have any questions regarding this application form,

please call the Utility Tax Exemption Unit (213) 978-3050/ TTY (213) 978-1532. When calling from the (818) area code, please call (818) 756-8121 then

proceed to dial 978-3050/ TTY (213) 978-1532. For DWP Lifeline Rate questions, please call 1-800-342-5397.

I certify, under penalty of perjury under the laws of the state of California, that the information I have provided in this application is true and correct. By

completing this form and submitting it to the Office of Finance in an electronic format, such as email, I agree that the form has the same legal effect as a

form submitted by U.S. Mail or in person. I agree that the Office of Finance and the Los Angeles Department of Water and Power can share my

information with other utilities or agencies to enroll me in their assistance programs. I understand that my information will be shared only with agencies

that offer discount programs that have agreed to keep the information confidential. I also agree that the aforementioned form legally represents a

document sent by me or my legal representative.

I DO NOT want to participate in other discount programs even though I may qualify, so please DO NOT share my information.

SIGNATURE

MONTH

DAY

YEAR

DATE

Code C0185

rev. 07/2014

Page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2