2015 T1 Adjustment Request Form

Download a blank fillable 2015 T1 Adjustment Request Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete 2015 T1 Adjustment Request Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

Clear Data

Help

Protected B

when completed

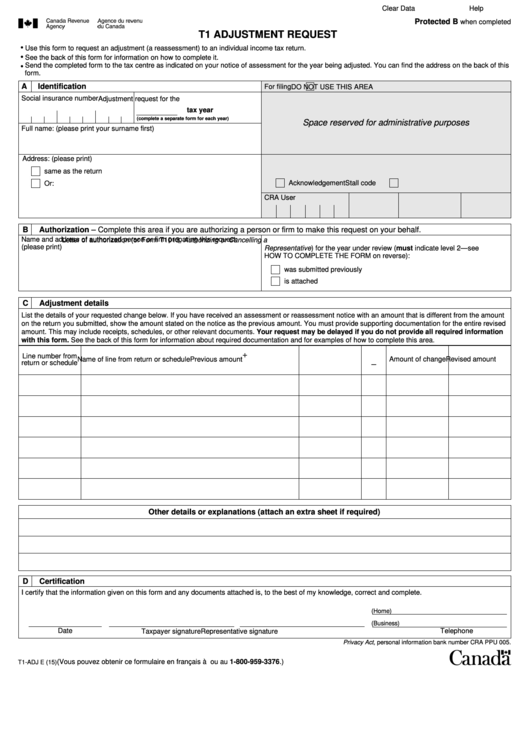

T1 ADJUSTMENT REQUEST

•

Use this form to request an adjustment (a reassessment) to an individual income tax return.

•

See the back of this form for information on how to complete it.

Send the completed form to the tax centre as indicated on your notice of assessment for the year being adjusted. You can find the address on the back of this

•

form.

A

Identification

For filing

DO NOT USE THIS AREA

Social insurance number

Adjustment request for the

tax year

(complete a separate form for each year)

Space reserved for administrative purposes

Full name: (please print your surname first)

Address: (please print)

same as the return

Acknowledgement

Stall code

Or:

CRA User ID

Date

Rev.

Date

B

Authorization – Complete this area if you are authorizing a person or firm to make this request on your behalf.

Name and address of authorized person or firm preparing this request:

Letter of authorization (or Form T1013, Authorizing or Cancelling a

(please print)

Representative) for the year under review (must indicate level 2—see

HOW TO COMPLETE THE FORM on reverse):

was submitted previously

is attached

C

Adjustment details

List the details of your requested change below. If you have received an assessment or reassessment notice with an amount that is different from the amount

on the return you submitted, show the amount stated on the notice as the previous amount. You must provide supporting documentation for the entire revised

amount. This may include receipts, schedules, or other relevant documents. Your request may be delayed if you do not provide all required information

with this form. See the back of this form for information about required documentation and for examples of how to complete this area.

+

Line number from

Name of line from return or schedule

Previous amount

Amount of change

Revised amount

return or schedule

–

Other details or explanations (attach an extra sheet if required)

D

Certification

I certify that the information given on this form and any documents attached is, to the best of my knowledge, correct and complete.

(Home)

(Business)

Date

Taxpayer signature

Representative signature

Telephone

Privacy Act, personal information bank number CRA PPU 005.

(Vous pouvez obtenir ce formulaire en français à ou au 1-800-959-3376.)

T1-ADJ E (15)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2