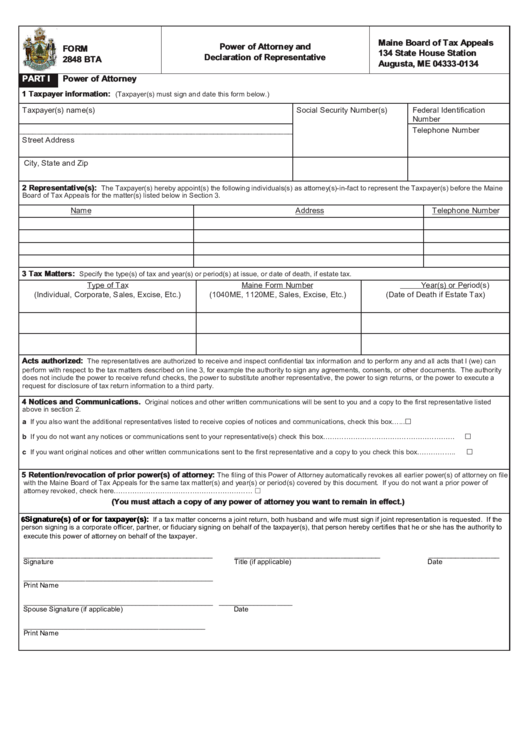

Power Of Attorney And Declaration Of Representative

ADVERTISEMENT

Maine Board of Tax Appeals

Power of Attorney and

FORM

134 State House Station

Declaration of Representative

2848 BTA

Augusta, ME 04333-0134

PART I

Power of Attorney

1 Taxpayer information:

(Taxpayer(s) must sign and date this form below.)

Taxpayer(s) name(s)

Social Security Number(s)

Federal Identification

Number

_______________________________________________________________

Telephone Number

Street Address

City, State and Zip

2 Representative(s):

The Taxpayer(s) hereby appoint(s) the following individuals(s) as attorney(s)-in-fact to represent the Taxpayer(s) before the Maine

Board of Tax Appeals for the matter(s) listed below in Section 3.

Name

Address

Telephone Number

3 Tax Matters:

Specify the type(s) of tax and year(s) or period(s) at issue, or date of death, if estate tax.

Type of Tax

Maine Form Number

Year(s) or Period(s)

(Individual, Corporate, Sales, Excise, Etc.)

(1040ME, 1120ME, Sales, Excise, Etc.)

(Date of Death if Estate Tax)

Acts authorized:

The representatives are authorized to receive and inspect confidential tax information and to perform any and all acts that I (we) can

perform with respect to the tax matters described on line 3, for example the authority to sign any agreements, consents, or other documents. The authority

does not include the power to receive refund checks, the power to substitute another representative, the power to sign returns, or the power to execute a

request for disclosure of tax return information to a third party.

4 Notices and Communications.

Original notices and other written communications will be sent to you and a copy to the first representative listed

above in section 2.

☐

a If you also want the additional representatives listed to receive copies of notices and communications, check this box…..............................

☐

b If you do not want any notices or communications sent to your representative(s) check this box…………………………………………………

☐

c If you want original notices and other written communications sent to the first representative and a copy to you check this box……………..

5 Retention/revocation of prior power(s) of attorney:

The filing of this Power of Attorney automatically revokes all earlier power(s) of attorney on file

with the Maine Board of Tax Appeals for the same tax matter(s) and year(s) or period(s) covered by this document. If you do not want a prior power of

attorney revoked, check here……………………………………………………....... ☐

(You must attach a copy of any power of attorney you want to remain in effect.)

_______________________________________________________________________________________________________________________________

Signature(s) of or for taxpayer(s):

6

If a tax matter concerns a joint return, both husband and wife must sign if joint representation is requested. If the

person signing is a corporate officer, partner, or fiduciary signing on behalf of the taxpayer(s), that person hereby certifies that he or she has the authority to

.

execute this power of attorney on behalf of the taxpayer

___________________________________________

_________________________________

________________

Signature

Title (if applicable)

Date

_________________________________________________

Print Name

_________________________________________________

___________________

Spouse Signature (if applicable)

Date

_______________________________________________

Print Name

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2