Ps Form 8039 - Back Pay Decision/settlement Worksheet

ADVERTISEMENT

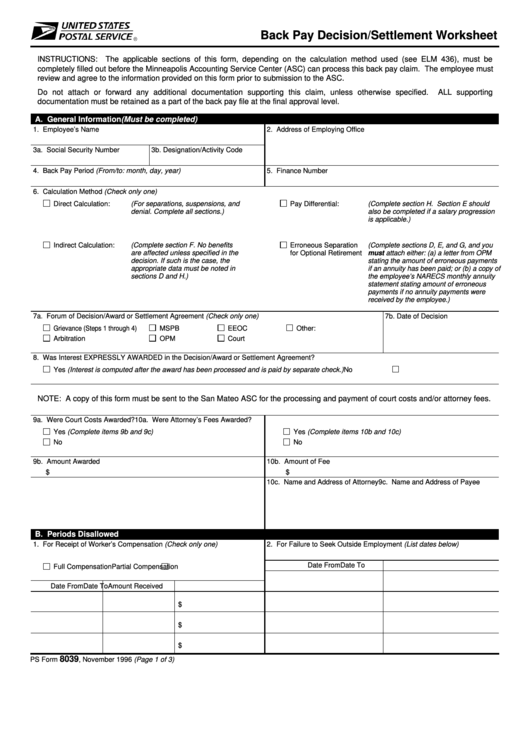

Back Pay Decision/Settlement Worksheet

INSTRUCTIONS: The applicable sections of this form, depending on the calculation method used (see ELM 436), must be

completely filled out before the Minneapolis Accounting Service Center (ASC) can process this back pay claim. The employee must

review and agree to the information provided on this form prior to submission to the ASC.

Do not attach or forward any additional documentation supporting this claim, unless otherwise specified.

ALL supporting

documentation must be retained as a part of the back pay file at the final approval level.

A. General Information (Must be completed)

1. Employee’s Name

2. Address of Employing Office

3a. Social Security Number

3b. Designation/Activity Code

4. Back Pay Period (From/to: month, day, year)

5. Finance Number

6. Calculation Method (Check only one)

Direct Calculation:

(For separations, suspensions, and

Pay Differential:

(Complete section H. Section E should

denial. Complete all sections.)

also be completed if a salary progression

is applicable.)

Indirect Calculation:

(Complete section F. No benefits

Erroneous Separation

(Complete sections D, E, and G, and you

are affected unless specified in the

for Optional Retirement

must attach either: (a) a letter from OPM

decision. If such is the case, the

stating the amount of erroneous payments

appropriate data must be noted in

if an annuity has been paid; or (b) a copy of

sections D and H.)

the employee’s NARECS monthly annuity

statement stating amount of erroneous

payments if no annuity payments were

received by the employee.)

7a. Forum of Decision/Award or Settlement Agreement (Check only one)

7b. Date of Decision

Grievance (Steps 1 through 4)

MSPB

EEOC

Other:

Arbitration

OPM

Court

8. Was Interest EXPRESSLY AWARDED in the Decision/Award or Settlement Agreement?

Yes (Interest is computed after the award has been processed and is paid by separate check.)

No

NOTE: A copy of this form must be sent to the San Mateo ASC for the processing and payment of court costs and/or attorney fees.

9a. Were Court Costs Awarded?

10a. Were Attorney’s Fees Awarded?

Yes (Complete items 9b and 9c)

Yes (Complete items 10b and 10c)

No

No

9b. Amount Awarded

10b. Amount of Fee

$

$

9c. Name and Address of Payee

10c. Name and Address of Attorney

B. Periods Disallowed

1. For Receipt of Worker’s Compensation (Check only one)

2. For Failure to Seek Outside Employment (List dates below)

Date From

Date To

Full Compensation

Partial Compensation

Date From

Date To

Amount Received

$

$

$

8039

PS Form

, November 1996 (Page 1 of 3)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Life

1

1 2

2 3

3