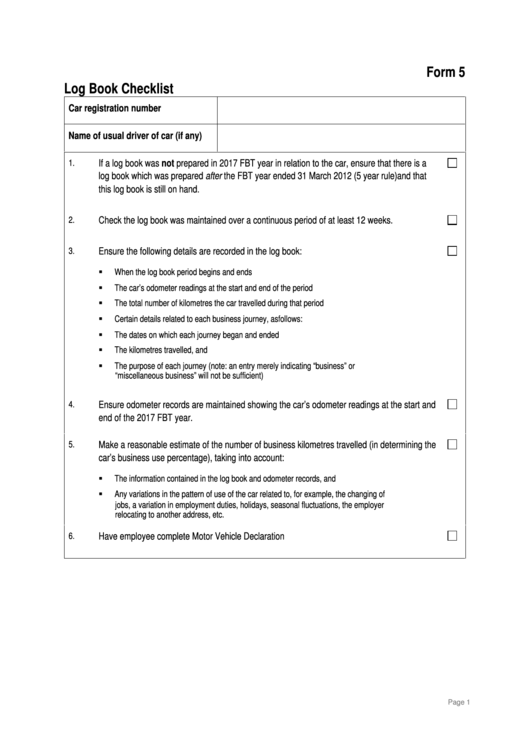

Log Book Checklist

ADVERTISEMENT

Form 5

Log Book Checklist

Car registration number

Name of usual driver of car (if any)

If a log book was not prepared in 2017 FBT year in relation to the car, ensure that there is a

1.

log book which was prepared after the FBT year ended 31 March 2012 (5 year rule) and that

this log book is still on hand.

2.

Check the log book was maintained over a continuous period of at least 12 weeks.

3.

Ensure the following details are recorded in the log book:

When the log book period begins and ends

The car’s odometer readings at the start and end of the period

The total number of kilometres the car travelled during that period

Certain details related to each business journey, as follows:

The dates on which each journey began and ended

The kilometres travelled, and

The purpose of each journey (note: an entry merely indicating “business” or

“miscellaneous business” will not be sufficient)

4.

Ensure odometer records are maintained showing the car’s odometer readings at the start and

end of the 2017 FBT year.

Make a reasonable estimate of the number of business kilometres travelled (in determining the

5.

car’s business use percentage), taking into account:

The information contained in the log book and odometer records, and

Any variations in the pattern of use of the car related to, for example, the changing of

jobs, a variation in employment duties, holidays, seasonal fluctuations, the employer

relocating to another address, etc.

6.

Have employee complete Motor Vehicle Declaration

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Miscellaneous

1

1