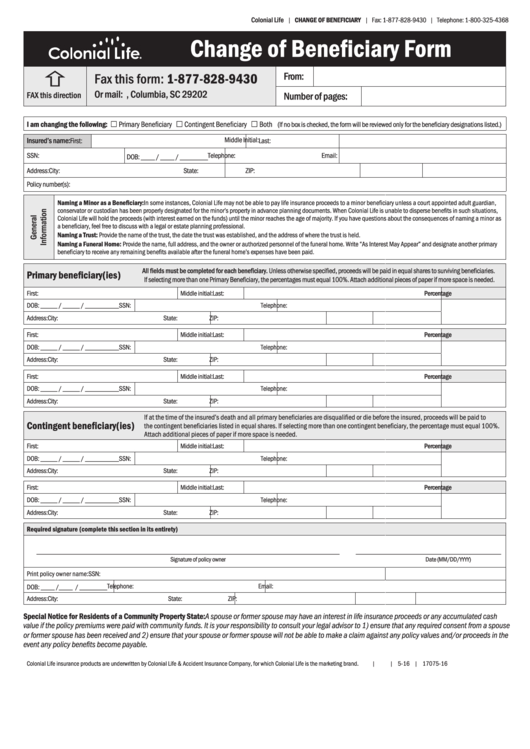

Change Of Beneficiary Form

ADVERTISEMENT

Colonial Life

| CHANGE OF BENEFICIARY | Fax: 1-877-828-9430 | Telephone: 1-800-325-4368

Change of Beneficiary Form

ñ

From:

Fax this form: 1-877-828-9430

Or mail: P.O. Box 100130, Columbia, SC 29202

Number of pages:

FAX this direction

I am changing the following: £ Primary Beneficiary £ Contingent Beneficiary £ Both

(If no box is checked, the form will be reviewed only for the beneficiary designations listed.)

Middle Initial:

Insured’s name:

First:

Last:

SSN:

Telephone:

Email:

DOB: ____ / ____ / ________

Address:

City:

State:

ZIP:

Policy number(s):

Naming a Minor as a Beneficiary: In some instances, Colonial Life may not be able to pay life insurance proceeds to a minor beneficiary unless a court appointed adult guardian,

conservator or custodian has been properly designated for the minor’s property in advance planning documents. When Colonial Life is unable to disperse benefits in such situations,

Colonial Life will hold the proceeds (with interest earned on the funds) until the minor reaches the age of majority. If you have questions about the consequences of naming a minor as

a beneficiary, feel free to discuss with a legal or estate planning professional.

Naming a Trust: Provide the name of the trust, the date the trust was established, and the address of where the trust is held.

Naming a Funeral Home: Provide the name, full address, and the owner or authorized personnel of the funeral home. Write “As Interest May Appear” and designate another primary

beneficiary to receive any remaining benefits available after the funeral home’s expenses have been paid.

All fields must be completed for each beneficiary. Unless otherwise specified, proceeds will be paid in equal shares to surviving beneficiaries.

Primary beneficiary(ies)

If selecting more than one Primary Beneficiary, the percentages must equal 100%. Attach additional pieces of paper if more space is needed.

First:

Middle initial:

Last:

Percentage

DOB: _____ / _____ / __________

SSN:

Telephone:

Address:

City:

State:

ZIP:

Percentage

First:

Middle initial:

Last:

DOB: _____ / _____ / __________

SSN:

Telephone:

Address:

City:

State:

ZIP:

First:

Middle initial:

Last:

Percentage

DOB: _____ / _____ / __________

SSN:

Telephone:

Address:

City:

State:

ZIP:

If at the time of the insured’s death and all primary beneficiaries are disqualified or die before the insured, proceeds will be paid to

Contingent beneficiary(ies)

the contingent beneficiaries listed in equal shares. If selecting more than one contingent beneficiary, the percentage must equal 100%.

Attach additional pieces of paper if more space is needed.

First:

Middle initial:

Last:

Percentage

DOB: _____ / _____ / __________

SSN:

Telephone:

Address:

City:

State:

ZIP:

Percentage

First:

Middle initial:

Last:

DOB: _____ / _____ / __________

SSN:

Telephone:

Address:

City:

State:

ZIP:

Required signature (complete this section in its entirety)

________________________________________________________________________________________________

______________________________________________

Signature of policy owner

Date (MM/DD/YYYY)

Print policy owner name:

SSN:

Telephone:

Email:

DOB: ____ /____ / ________

Address:

City:

State:

ZIP:

Special Notice for Residents of a Community Property State: A spouse or former spouse may have an interest in life insurance proceeds or any accumulated cash

value if the policy premiums were paid with community funds. It is your responsibility to consult your legal advisor to 1) ensure that any required consent from a spouse

or former spouse has been received and 2) ensure that your spouse or former spouse will not be able to make a claim against any policy values and/or proceeds in the

event any policy benefits become payable.

Colonial Life insurance products are underwritten by Colonial Life & Accident Insurance Company, for which Colonial Life is the marketing brand.

|

| 5-16 | 17075-16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1