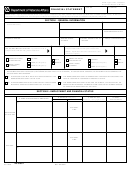

SECTION III - NET WORTH STATEMENT

26. ASSETS

A. REAL ESTATE (Market value of real estate owned)

$

B. CASH (The total amount in savings, checking, and money market accounts)

C. SECURITIES (Marketable value of stocks, bonds, mutual funds, shares and other securities)

D. INSURANCE (Cash value of borrower's life insurance policies)

E. RETIREMENT INCOME ACCOUNTS (IRA, Keogh Plan, Employer Sponsored, etc.)

F. VEHICLES (Include trucks, vans, boats, campers, airplanes, motorcycles and automobiles)

G. APPLIANCES (Cash value of washer/dryer, television set, etc.)

H. HOME FURNISHINGS (Cash value of furniture, fixtures, etc.)

I. OTHER ASSETS (Market value of jewelry, stamp collection, etc.)

J. TOTAL ASSETS

$

27. LIABILITIES

(1) MORTGAGE PRINCIPAL(S)

$

A. LONG-TERM

(2) AUTOMOBILE LOAN(S)

DEBT BALANCES

THAT GO BEYOND

ONE YEAR

(3) APPLIANCE LOAN(S)

(Outstanding Balance)

(4) EDUCATION LOAN(S)

(1) DEPARTMENT STORE CHARGE ACCOUNTS

(2) OTHER CHARGE ACCOUNTS

B. SHORT-TERM

BALANCES TO

BE PAID WITHIN

(3) OTHER INSTALLMENT CREDIT

ONE YEAR

(4) OTHER FAMILY DEBTS (Medical, back taxes, etc.)

C. TOTAL LIABILITIES

$

28. NET WORTH (Item 26J minus Item 27C)

$

(Include any areas where expenses can be reduced or income can be increased so obligor(s) can meet loan obligations)

29. COMMENTS AND SUGGESTIONS

30. WAS AN UNDERSTANDING REACHED WITH OBLIGOR(S) ON STEPS NECESSARY TO ALIGN EXPENSES

31. WAS A MONTHLY BUDGET PREPARED?

WITH INCOME?

YES

NO

YES

NO

32. SCHEDULE OF PROPOSED PAYMENTS

DATE

AMOUNT

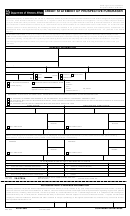

SECTION IV - SIGNATURES

PRIVACY ACT NOTICE: VA will not disclose information collected on this form to any source other than what has been authorized under the Privacy Act of 1974

or Title 38, Code of Federal Regulations 1.576 for routine uses (i.e., to a member of Congress inquiring on your behalf) as identified in the VA system of records,

55VA26, Loan Guaranty Home, Condominium and Manufactured Home Loan Applicant Records, Specially Adapted Housing Applicant Records, and Vendee Loan

Applicant Records - VA, and published in the Federal Register. Your obligation to respond is voluntary, but without this information, VA may be unable to provide

financial counseling or assistance in dealing with your mortgage loan holder.

RESPONDENT BURDEN: We need this information to service your loan and to evaluate your alternatives to foreclosure. Title 38, United States Code, allows us to

ask for this information. We estimate that you will need an average of 45 minutes to review the instruction, find the information, and complete this form. VA cannot

conduct or sponsor a collection of information unless a valid OMB control number is displayed. You are not required to respond to a collection of information if this

number is not displayed. Valid OMB control numbers can be located on the OMB Internet Page at

If desired, you can call 1-800-827-1000 to get information on where to send comments or suggestions about this form.

33. SIGNATURE OF BORROWER/APPLICANT

34. DATE

35. SIGNATURE OF SPOUSE

36. DATE

37. DATE

38. SIGNATURE OF REPRESENTATIVE

VA FORM 26-8844, JUN 2008

1

1 2

2