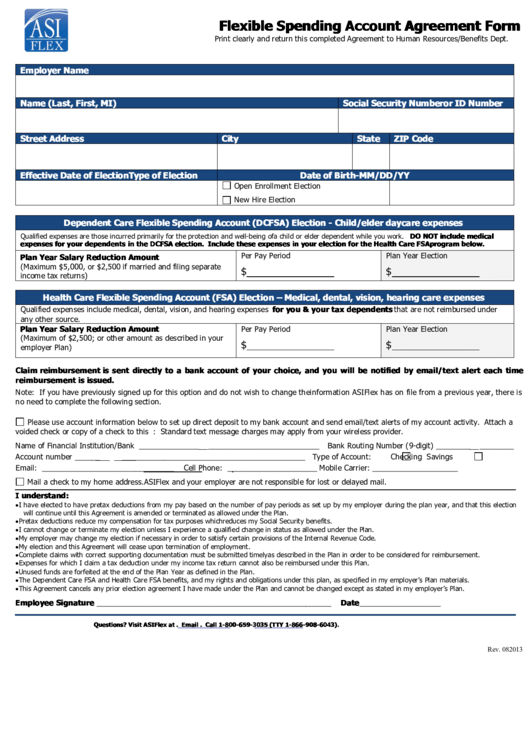

Flexible Spending Account Agreement Form

ADVERTISEMENT

Flexible Spending Account Agreement Form

Print clearly and return this completed Agreement to Human Resources/Benefits Dept.

Employer Name

Name (Last, First, MI)

Social Security Number or ID Number

Street Address

City

State

ZIP Code

Effective Date of Election

Type of Election

Date of Birth-MM/DD/YY

Open Enrollment Election

New Hire Election

Dependent Care Flexible Spending Account (DCFSA) Election - Child/elder daycare expenses

Qualified expenses are those incurred primarily for the protection and well-being of a child or elder dependent while you work. DO NOT include medical

expenses for your dependents in the DCFSA election. Include these expenses in your election for the Health Care FSA program below.

Per Pay Period

Plan Year Election

Plan Year Salary Reduction Amount

(Maximum $5,000, or $2,500 if married and filing separate

$

$

income tax returns)

Health Care Flexible Spending Account (FSA) Election – Medical, dental, vision, hearing care expenses

Qualified expenses include medical, dental, vision, and hearing expenses for you & your tax dependents that are not reimbursed under

any other source.

Plan Year Salary Reduction Amount

Per Pay Period

Plan Year Election

(Maximum of $2,500; or other amount as described in your

$

$

employer Plan)

Claim reimbursement is sent directly to a bank account of your choice, and you will be notified by email/text alert each time

reimbursement is issued.

Note: If you have previously signed up for this option and do not wish to change the information ASIFlex has on file from a previous year, there is

no need to complete the following section.

Please use account information below to set up direct deposit to my bank account and send email/text alerts of my account activity. Attach a

voided check or copy of a check to this form. Note: Standard text message charges may apply from your wireless provider.

Name of Financial Institution/Bank ______________

__________________________ Bank Routing Number (9-digit) ________

________

Account number _____

_

___________________________________________ Type of Account:

Checking

Savings

Email: ________________________

_______

Cell Phone: _____________________ Mobile Carrier: ____________________

Mail a check to my home address. ASIFlex and your employer are not responsible for lost or delayed mail.

I understand:

• I have elected to have pretax deductions from my pay based on the number of pay periods as set up by my employer during the plan year, and that this election

will continue until this Agreement is amended or terminated as allowed under the Plan.

• Pretax deductions reduce my compensation for tax purposes which reduces my Social Security benefits.

• I cannot change or terminate my election unless I experience a qualified change in status as allowed under the Plan.

• My employer may change my election if necessary in order to satisfy certain provisions of the Internal Revenue Code.

• My election and this Agreement will cease upon termination of employment.

• Complete claims with correct supporting documentation must be submitted timely as described in the Plan in order to be considered for reimbursement.

• Expenses for which I claim a tax deduction under my income tax return cannot also be reimbursed under this Plan.

• Unused funds are forfeited at the end of the Plan Year as defined in the Plan.

• The Dependent Care FSA and Health Care FSA benefits, and my rights and obligations under this plan, as specified in my employer’s Plan materials.

• This Agreement cancels any prior election agreement I have made under the Plan and cannot be changed except as stated in my employer’s Plan.

Employee Signature _______________________________________________________

Date ___________________

Questions? Visit ASIFlex at Email . Call 1-800-659-3035 (TTY 1-866-908-6043).

Rev. 082013

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1