Form-22 Report Of Securities

Download a blank fillable Form-22 Report Of Securities in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form-22 Report Of Securities with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

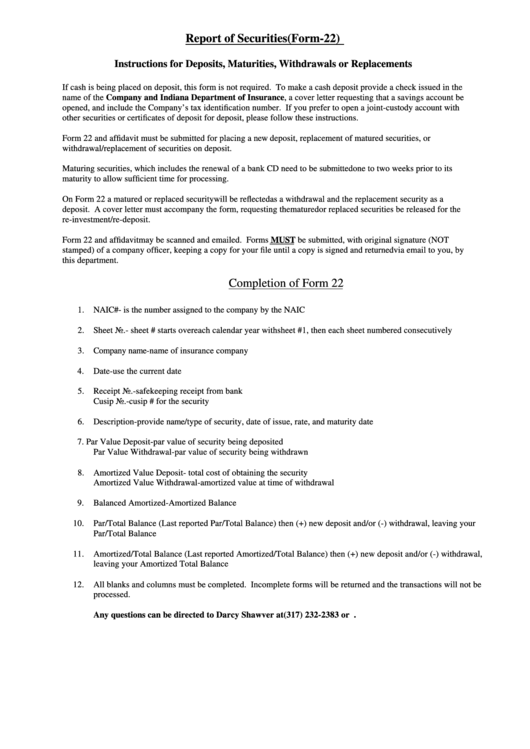

Report of Securities (Form-22)

Instructions for Deposits, Maturities, Withdrawals or Replacements

If cash is being placed on deposit, this form is not required. To make a cash deposit provide a check issued in the

name of the Company and Indiana Department of Insurance, a cover letter requesting that a savings account be

opened, and include the Company’s tax identification number. If you prefer to open a joint-custody account with

other securities or certificates of deposit for deposit, please follow these instructions.

Form 22 and affidavit must be submitted for placing a new deposit, replacement of matured securities, or

withdrawal/replacement of securities on deposit.

Maturing securities, which includes the renewal of a bank CD need to be submitted one to two weeks prior to its

maturity to allow sufficient time for processing.

On Form 22 a matured or replaced security will be reflected as a withdrawal and the replacement security as a

deposit. A cover letter must accompany the form, requesting the matured or replaced securities be released for the

re-investment/re-deposit.

Form 22 and affidavit may be scanned and emailed. Forms MUST be submitted, with original signature (NOT

stamped) of a company officer, keeping a copy for your file until a copy is signed and returned via email to you, by

this department.

Completion of Form 22

1.

NAIC#- is the number assigned to the company by the NAIC

2.

Sheet No.- sheet # starts over each calendar year with sheet #1, then each sheet numbered consecutively

3.

Company name-name of insurance company

4.

Date-use the current date

5.

Receipt No.-safekeeping receipt from bank

Cusip No.-cusip # for the security

6.

Description-provide name/type of security, date of issue, rate, and maturity date

7.

Par Value Deposit-par value of security being deposited

Par Value Withdrawal-par value of security being withdrawn

8.

Amortized Value Deposit- total cost of obtaining the security

Amortized Value Withdrawal-amortized value at time of withdrawal

9.

Balanced Amortized-Amortized Balance

10.

Par/Total Balance (Last reported Par/Total Balance) then (+) new deposit and/or (-) withdrawal, leaving your

Par/Total Balance

11.

Amortized/Total Balance (Last reported Amortized/Total Balance) then (+) new deposit and/or (-) withdrawal,

leaving your Amortized Total Balance

12.

All blanks and columns must be completed. Incomplete forms will be returned and the transactions will not be

processed.

Any questions can be directed to Darcy Shawver at (317) 232-2383 or dshawver@idoi.in.gov .

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3