Form 5469 - City Of Detroit Income Tax Withholding Guide - State Of Michigan - 2017

ADVERTISEMENT

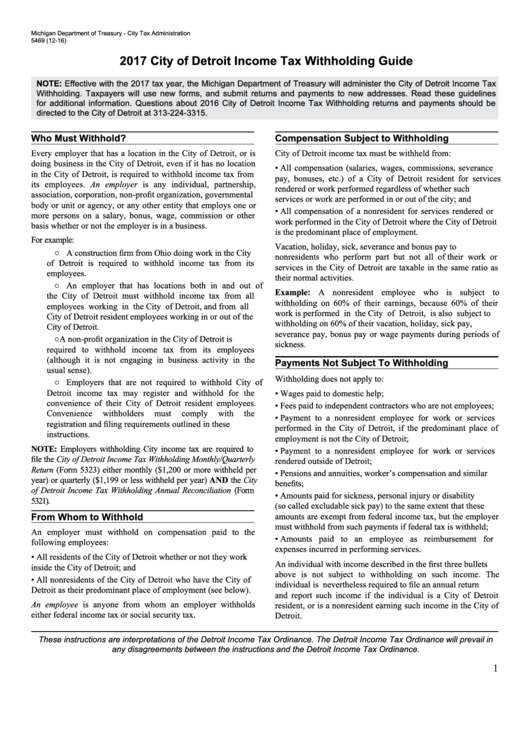

Michigan Department of Treasury - City Tax Administration

5469 (12-16)

2017 City of Detroit Income Tax Withholding Guide

NOTE: Effective with the 2017 tax year, the Michigan Department of Treasury will administer the City of Detroit Income Tax

Withholding. Taxpayers will use new forms, and submit returns and payments to new addresses. Read these guidelines

for additional information. Questions about 2016 City of Detroit Income Tax Withholding returns and payments should be

directed to the City of Detroit at 313-224-3315.

Who Must Withhold?

Compensation Subject to Withholding

Every employer that has a location in the City of Detroit, or is

City of Detroit income tax must be withheld from:

doing business in the City of Detroit, even if it has no location

• All compensation (salaries, wages, commissions, severance

in the City of Detroit, is required to withhold income tax from

pay, bonuses, etc.) of a City of Detroit resident for services

its employees. An employer is any individual, partnership,

rendered or work performed regardless of whether such

association, corporation, non-profit organization, governmental

services or work are performed in or out of the city; and

body or unit or agency, or any other entity that employs one or

• All compensation of a nonresident for services rendered or

more persons on a salary, bonus, wage, commission or other

work performed in the City of Detroit where the City of Detroit

basis whether or not the employer is in a business.

is the predominant place of employment.

For example:

Vacation, holiday, sick, severance and bonus pay to

○ A construction firm from Ohio doing work in the City

nonresidents who perform part but not all of their work or

of Detroit is required to withhold income tax from its

services in the City of Detroit are taxable in the same ratio as

employees.

their normal activities.

○ An employer that has locations both in and out of

Example: A nonresident employee who is subject to

the City of Detroit must withhold income tax from all

withholding on 60% of their earnings, because 60% of their

employees working in the City of Detroit, and from all

work is performed in the City of Detroit, is also subject to

City of Detroit resident employees working in or out of the

withholding on 60% of their vacation, holiday, sick pay,

City of Detroit.

severance pay, bonus pay or wage payments during periods of

○ A non-profit organization in the City of Detroit is

sickness.

required to withhold income tax from its employees

(although it is not engaging in business activity in the

Payments Not Subject To Withholding

usual sense).

Withholding does not apply to:

○ Employers that are not required to withhold City of

Detroit income tax may register and withhold for the

• Wages paid to domestic help;

convenience of their City of Detroit resident employees.

• Fees paid to independent contractors who are not employees;

Convenience

withholders

must

comply

with

the

• Payment to a nonresident employee for work or services

registration and filing requirements outlined in these

performed in the City of Detroit, if the predominant place of

instructions.

employment is not the City of Detroit;

NOTE: Employers withholding City income tax are required to

• Payment to a nonresident employee for work or services

file the City of Detroit Income Tax Withholding Monthly/Quarterly

rendered outside of Detroit;

Return (Form 5323) either monthly ($1,200 or more withheld per

• Pensions and annuities, worker’s compensation and similar

year) or quarterly ($1,199 or less withheld per year) AND the City

benefits;

of Detroit Income Tax Withholding Annual Reconciliation (Form

• Amounts paid for sickness, personal injury or disability

5321).

(so called excludable sick pay) to the same extent that these

From Whom to Withhold

amounts are exempt from federal income tax, but the employer

must withhold from such payments if federal tax is withheld;

An employer must withhold on compensation paid to the

• Amounts paid to an employee as reimbursement for

following employees:

expenses incurred in performing services.

• All residents of the City of Detroit whether or not they work

An individual with income described in the first three bullets

inside the City of Detroit; and

above is not subject to withholding on such income. The

• All nonresidents of the City of Detroit who have the City of

individual is nevertheless required to file an annual return

Detroit as their predominant place of employment (see below).

and report such income if the individual is a City of Detroit

An employee is anyone from whom an employer withholds

resident, or is a nonresident earning such income in the City of

either federal income tax or social security tax.

Detroit.

These instructions are interpretations of the Detroit Income Tax Ordinance. The Detroit Income Tax Ordinance will prevail in

any disagreements between the instructions and the Detroit Income Tax Ordinance.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4