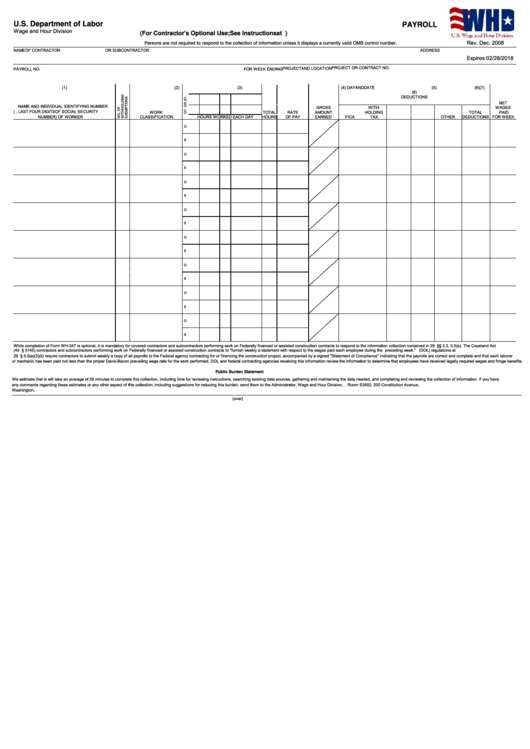

U.s. Department Of Labor - Payroll

ADVERTISEMENT

U.S. Department of Labor

PAYROLL

Wage and Hour Division

(For Contractor's Optional Use; See Instructions at )

Rev. Dec. 2008

Persons are not required to respond to the collection of information unless it displays a currently valid OMB control number.

NAME OF CONTRACTOR

OR SUBCONTRACTOR

ADDRESS

OMB No.: 1235-0008

Expires: 02/28/2018

PROJECT OR CONTRACT NO.

PROJECT AND LOCATION

PAYROLL NO.

FOR WEEK ENDING

(1)

(2)

(3)

(4) DAY AND DATE

(5)

(6)

(7)

(9)

(8)

DEDUCTIONS

NET

NAME AND INDIVIDUAL IDENTIFYING NUMBER

GROSS

WITH-

WAGES

(e.g., LAST FOUR DIGITS OF SOCIAL SECURITY

WORK

TOTAL

RATE

AMOUNT

HOLDING

TOTAL

PAID

NUMBER) OF WORKER

CLASSIFICATION

HOURS WORKED EACH DAY

HOURS

OF PAY

EARNED

FICA

TAX

OTHER

DEDUCTIONS

FOR WEEK

O

S

O

S

O

S

O

S

O

S

O

S

O

S

O

S

While completion of Form WH-347 is optional, it is mandatory for covered contractors and subcontractors performing work on Federally financed or assisted construction contracts to respond to the information collection contained in 29 C.F.R. §§ 3.3, 5.5(a). The Copeland Act

(40 U.S.C. § 3145) contractors and subcontractors performing work on Federally financed or assisted construction contracts to "furnish weekly a statement with respect to the wages paid each employee during the preceding week." U.S. Department of Labor (DOL) regulations at

29 C.F.R. § 5.5(a)(3)(ii) require contractors to submit weekly a copy of all payrolls to the Federal agency contracting for or financing the construction project, accompanied by a signed "Statement of Compliance" indicating that the payrolls are correct and complete and that each laborer

or mechanic has been paid not less than the proper Davis-Bacon prevailing wage rate for the work performed. DOL and federal contracting agencies receiving this information review the information to determine that employees have received legally required wages and fringe benefits.

Public Burden Statement

We estimate that is will take an average of 55 minutes to complete this collection, including time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. If you have

any comments regarding these estimates or any other aspect of this collection, including suggestions for reducing this burden, send them to the Administrator, Wage and Hour Division, U.S. Department of Labor, Room S3502, 200 Constitution Avenue, N.W.

Washington, D.C. 20210

(over)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2