Form Dw-4 - Employee'S Withholding Certificate Income Tax - City Of Detroit

ADVERTISEMENT

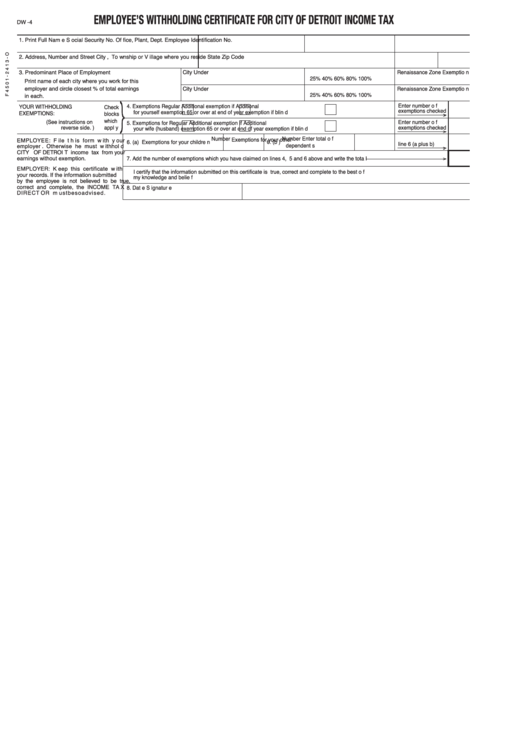

EMPLOYEE’S WITHHOLDING CERTIFICATE FOR CITY OF DETROIT INCOME TAX

DW -4

1. Print Full Nam e

S ocial Security No.

Of fice, Plant, Dept.

Employee Identification No.

2. Address, Number and Street

City , To wnship or V illage where you reside

State

Zip Code

3. Predominant Place of Employment

City

Under

Renaissance Zone Exemptio n

25%

40%

60%

80% 100%

Print name of each city where you work for this

employer and circle closest % of total earnings

City

Under

Renaissance Zone Exemptio n

25%

40%

60%

80% 100%

in each.

Enter number o f

4. Exemptions

Regular

Additional exemption if

Additional

YOUR WITHHOLDING

Check

exemptions checked

for yourself

exemption

65 or over at end of year

exemption if blin d

EXEMPTIONS:

blocks

which

(See instructions on

Enter number o f

5. Exemptions for

Regular

Additional exemption if

Additional

reverse side. )

appl y

exemptions checked

your wife (husband)

exemption

65 or over at end of year

exemption if blin d

Number

Number

Enter total o f

Exemptions for your other

EMPLOYEE: F ile t h is form w ith y our

6. (a) Exemptions for your childre n

6. (b )

line 6 (a plus b)

dependent s

employer . Otherwise he must w ithhol d

CITY OF DETROI T income tax from your

earnings without exemption.

7. Add the number of exemptions which you have claimed on lines 4, 5 and 6 above and write the tota l

EMPLOYER: K eep this certificate w ith

I certify that the information submitted on this certificate is true, correct and complete to the best o f

your records. If the information submitted

my knowledge and belie f

by the employee is not believed to be true,

correct and complete, the INCOME TA X

8. Dat e

S ignatur e

DIRECT OR m ust be so advised.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2