Definitions for Schedule of Sales to State/Tribal Compact Border Rate

Federally Recognized Indian Tribes or Nations

Schedules 18-10-S

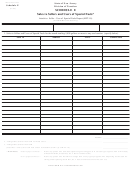

A. Complete all information regarding your wholesale company.

B. Select the 18-10-S Schedule appropriate to your tribal customer.

C. Complete one 18-10-S Schedule per smoke shop.

D. List all sales to this smokeshop by invoice number and date, including the total of each product category on that

invoice.

E. Enter the total of each product category sold on line 1.

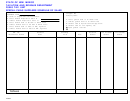

In State Wholesalers Only: Enter the total of each product category sold on the appropriate line of Column E on Form

TOB50002.

F. Calculate all tax types listed for each product category; 2004 and Prior Tax (if applicable), 2005 Tax (if applicable),

Tribal Trust Tax (if applicable).

G. Transfer each tax type total (2004 and Prior Tax, 2005 Tax, Tribal Trust Tax) for all Schedules 18-10-S to the Monthly

Return of Tobacco Products Sold to Federally Recognized Indian Tribes or Nations, Form TOB50003.

Definitions

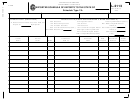

“Oklahoma Rate” - means all full-tax-rate locations in the State of Oklahoma and retail locations located on trust land

owned or licensed by Federally Recognized Indian Tribes or Nations, which have NOT signed a compact with the State of

Oklahoma regarding cigarette and tobacco products.

“State/Tribal Border Compact” - means retail locations located on trust land owned or licensed by Federally Recognized

Indian Tribes or Nations, which signed compacts with the State of Oklahoma regarding cigarette and tobacco products

after July1, 2008 and are located within twenty (20) miles of the state line between Oklahoma and Kansas or Oklahoma

and Missouri.

“New Compact” - means retail locations located on trust land owned or licensed by Federally Recognized Indian Tribes

or Nations, which signed compacts with the State of Oklahoma regarding cigarette and tobacco products after January 1,

2003.

“Exception Rate” - means certain retail locations on trust lands in other specific locations, owned or licensed by Federally

Recognized Indian Tribes or Nations which signed compacts with the State of Oklahoma regarding cigarettes and tobacco

products after January 1, 2003 and are located within twenty (20) miles of the state line between Oklahoma and Kansas

or Oklahoma and Missouri.

“State/Tribal Compact” - means retail locations located on trust land owned or licensed by Federally Recognized Indian

Tribes or Nations, which signed compacts with the State of Oklahoma regarding cigarette and tobacco products after

July1, 2008.

“Black Stamp” or “No Tax Rate” - retail locations located on trust land owned or licensed by Federally Recognized Indian

Tribes or Nations, which have NOT signed a compact with the State of Oklahoma regarding cigarette and tobacco

products. This tobacco product can only be sold to that tribe’s tribal member.

1

1 2

2