Wh-1612 Instructions South Carolina Withholding Form

ADVERTISEMENT

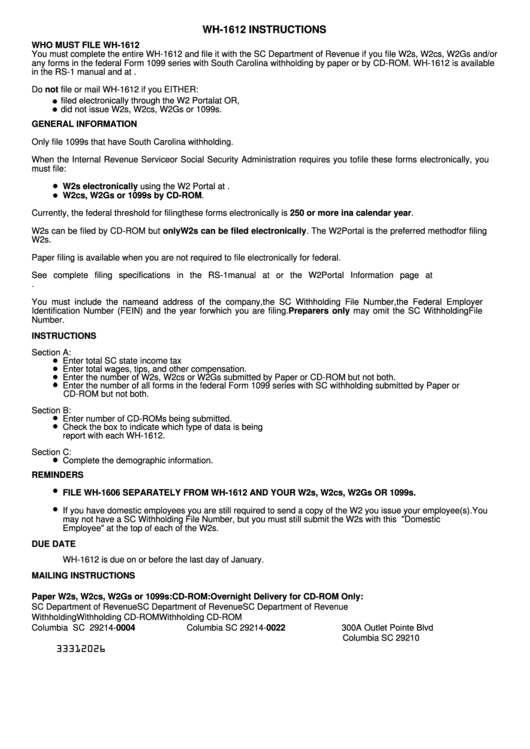

WH-1612 INSTRUCTIONS

WHO MUST FILE WH-1612

You must complete the entire WH-1612 and file it with the SC Department of Revenue if you file W2s, W2cs, W2Gs and/or

any forms in the federal Form 1099 series with South Carolina withholding by paper or by CD-ROM. WH-1612 is available

in the RS-1 manual and at dor.sc.gov.

Do not file or mail WH-1612 if you EITHER:

filed electronically through the W2 Portal at OR,

did not issue W2s, W2cs, W2Gs or 1099s.

GENERAL INFORMATION

Only file 1099s that have South Carolina withholding.

When the Internal Revenue Service or Social Security Administration requires you to file these forms electronically, you

must file:

W2s electronically using the W2 Portal at .

W2cs, W2Gs or 1099s by CD-ROM.

Currently, the federal threshold for filing these forms electronically is 250 or more in a calendar year.

W2s can be filed by CD-ROM but only W2s can be filed electronically. The W2 Portal is the preferred method for filing

W2s.

Paper filing is available when you are not required to file electronically for federal.

See complete filing specifications in the RS-1 manual at dor.sc.gov or the W2 Portal Information page at

.

You must include the name and address of the company, the SC Withholding File Number, the Federal Employer

Identification Number (FEIN) and the year for which you are filing. Preparers only may omit the SC Withholding File

Number.

INSTRUCTIONS

Section A:

Enter total SC state income tax withheld. This is the sum of income tax withheld from W2s or 1099s.

Enter total wages, tips, and other compensation.

Enter the number of W2s, W2cs or W2Gs submitted by Paper or CD-ROM but not both.

Enter the number of all forms in the federal Form 1099 series with SC withholding submitted by Paper or

CD-ROM but not both.

Section B:

Enter number of CD-ROMs being submitted.

Check the box to indicate which type of data is being submitted. CD-ROM filers may use only one type of data to

report with each WH-1612.

Section C:

Complete the demographic information.

REMINDERS

FILE WH-1606 SEPARATELY FROM WH-1612 AND YOUR W2s, W2cs, W2Gs OR 1099s.

If you have domestic employees you are still required to send a copy of the W2 you issue your employee(s). You

may not have a SC Withholding File Number, but you must still submit the W2s with this form. Write "Domestic

Employee" at the top of each of the W2s.

DUE DATE

WH-1612 is due on or before the last day of January.

MAILING INSTRUCTIONS

Paper W2s, W2cs, W2Gs or 1099s:

CD-ROM:

Overnight Delivery for CD-ROM Only:

SC Department of Revenue

SC Department of Revenue

SC Department of Revenue

Withholding

Withholding CD-ROM

Withholding CD-ROM

Columbia SC 29214-0004

Columbia SC 29214-0022

300A Outlet Pointe Blvd

Columbia SC 29210

33312026

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1