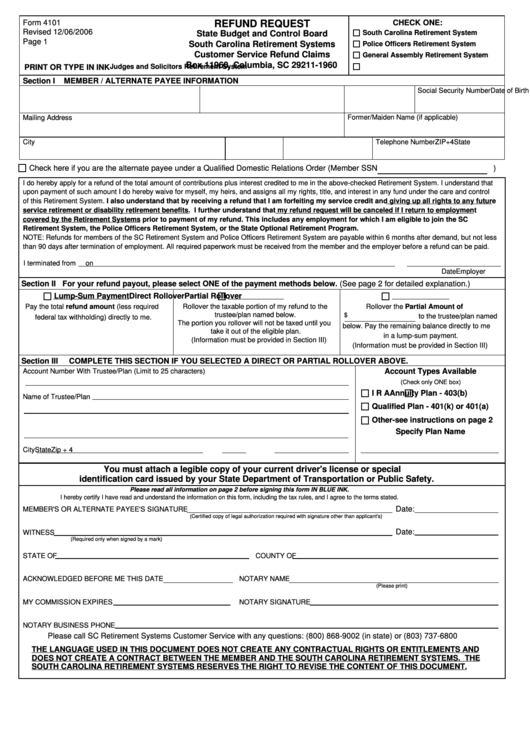

Refund Request - Form 4101 South Carolina Retirement Systems

ADVERTISEMENT

Form 4101

REFUND REQUEST

CHECK ONE:

Revised 12/06/2006

South Carolina Retirement System

State Budget and Control Board

Page 1

South Carolina Retirement Systems

Police Officers Retirement System

Customer Service Refund Claims

General Assembly Retirement System

Box 11960, Columbia, SC 29211-1960

Judges and Solicitors Retirement System

PRINT OR TYPE IN INK

Section I

MEMBER / ALTERNATE PAYEE INFORMATION

Last Name & Suffix

First/Middle Name

Date of Birth

Social Security Number

Former/Maiden Name (if applicable)

Mailing Address

City

State

ZIP+4

Telephone Number

Check here if you are the alternate payee under a Qualified Domestic Relations Order (Member SSN

)

I do hereby apply for a refund of the total amount of contributions plus interest credited to me in the above-checked Retirement System. I understand that

upon payment of such amount I do hereby waive for myself, my heirs, and assigns all my rights, title, and interest in any fund under the care and control

of this Retirement System. I also understand that by receiving a refund that I am forfeiting my service credit and giving up all rights to any future

service retirement or disability retirement benefits. I further understand that my refund request will be canceled if I return to employment

covered by the Retirement Systems prior to payment of my refund. This includes any employment for which I am eligible to join the SC

Retirement System, the Police Officers Retirement System, or the State Optional Retirement Program.

NOTE: Refunds for members of the SC Retirement System and Police Officers Retirement System are payable within 6 months after demand, but not less

than 90 days after termination of employment. All required paperwork must be received from the member and the employer before a refund can be paid.

I terminated from

on

Employer

Date

Section II For your refund payout, please select ONE of the payment methods below. (See page 2 for detailed explanation.)

Lump-Sum Payment

Direct Rollover

Partial Rollover

Pay the total refund amount (less required

Rollover the taxable portion of my refund to the

Rollover the Partial Amount of

trustee/plan named below.

$

to the trustee/plan named

federal tax withholding) directly to me.

The portion you rollover will not be taxed until you

below. Pay the remaining balance directly to me

take it out of the eligible plan.

in a lump-sum payment.

(Information must be provided in Section III)

(Information must be provided in Section III)

Section III

COMPLETE THIS SECTION IF YOU SELECTED A DIRECT OR PARTIAL ROLLOVER ABOVE.

Account Number With Trustee/Plan (Limit to 25 characters)

Account Types Available

(Check only ONE box)

I R A

Annuity Plan - 403(b)

Name of Trustee/Plan

Qualified Plan - 401(k) or 401(a)

Other-see instructions on page 2

P.O. Box or Street Address

Specify Plan Name

City

State

Zip + 4

You must attach a legible copy of your current driver's license or special

identification card issued by your State Department of Transportation or Public Safety.

Please read all information on page 2 before signing this form IN BLUE INK.

I hereby certify I have read and understand the information on this form, including the tax rules, and I agree to the terms stated.

Date:

MEMBER'S OR ALTERNATE PAYEE'S SIGNATURE

(Certified copy of legal authorization required with signature other than applicant's)

Date:

WITNESS

(Required only when signed by a mark)

STATE OF

COUNTY OF

ACKNOWLEDGED BEFORE ME THIS DATE

NOTARY NAME

(Please print)

MY COMMISSION EXPIRES

NOTARY SIGNATURE

NOTARY BUSINESS PHONE

Please call SC Retirement Systems Customer Service with any questions: (800) 868-9002 (in state) or (803) 737-6800

THE LANGUAGE USED IN THIS DOCUMENT DOES NOT CREATE ANY CONTRACTUAL RIGHTS OR ENTITLEMENTS AND

DOES NOT CREATE A CONTRACT BETWEEN THE MEMBER AND THE SOUTH CAROLINA RETIREMENT SYSTEMS. THE

SOUTH CAROLINA RETIREMENT SYSTEMS RESERVES THE RIGHT TO REVISE THE CONTENT OF THIS DOCUMENT.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2