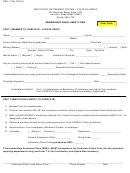

New Employees:

Below are examples of qualifying life events; other similar circumstances may also

• May elect health coverage at time of hire; however, this coverage will be effective

represent a qualifying life event. Remember, rules will determine if you can enroll in or

when you have satisfied your waiting period.

make the insurance changes you want. You may either enter your changes using your

online account at or send this form to your benefits coordinator.

Employees making changes to their benefits options during the plan year:

If you are a Health and Human Services Enterprise employee, you may send this form

• Use this form to indicate only the changes you want to make.

to HHS Employee Service Center. If you do not make changes within 31 days, you

• Complete this form on or within 31 days after your qualifying life event (QLE)

may not be eligible to make the changes you want.

(birth, marriage, etc.).

• Using the chart below, identify a reason code (required in Section C) when

changing insurance coverage.

Family Status Change Reference Chart

Participant gets married

MAR

Employee Marital Status Change

Participant gets a divorce or an annulment

DIV

Death of a spouse

DOD

Birth of a newborn child

BIR

Participant adopts, fosters, or gets court-appointed guardianship,

ADP

or becomes managing conservator of a child

Participant gains or loses dependent(s) through death

DOD

Dependent becomes eligible or loses eligibility for insurance coverage

Dependent Status Change

DEP

(Example: Participant’s spouse is covering their child. The child lost eligibility for

the spouse’s insurance because the child does not attend school.)

Dependent is related by blood or marriage, and was previously claimed on the participant’s income tax

XMO

return, but is no longer eligible to be claimed on participants income tax return

Child gets married

DGM

Participant/Dependent employment status change

ESC

Employment Status Change

Dependent becomes eligible for insurance after a waiting period

DWP

Address Change that Changes

Dependent moves out of health or dental plan service area

DMV

Dependent Eligibility

Participant/Dependent gains Medicare/Medicaid/CHIP eligibility

MDG*

Medicare/Medicaid/CHIP

Eligibility Change

Participant/Dependent loses Medicare/Medicaid/CHIP eligibility

MDL*

Significant change in cost by day care provider

SCC

Significant Change in Cost/Coverage

Significant change in cost/coverage of dependent’s health or dental plan (excluding GBP)

SCC

Imposed byThird Party

HIPP approval or loss of eligibility

SCC

Participant gains requirement to provide coverage for child through a National Medical Support Notice

(NMSN) issued by the Office of the Attorney General (OAG)

MSO

Office of the Attorney General (OAG)

(Example: employee receives an NMSN to provide health coverage for his child.)

Ordered Coverage Change

NMSN issued by the Office of the Attorney General (OAG), which requires

(Eligibility rules apply for

participant to provide coverage for child expires

these dependents)

MSD**

(Example: employee’s NMSN to provide health coverage for his child expires and the employee is no longer

required to continue coverage for the child.)

* DEPENDENT ENROLLMENT INFORMATION:

CHIPRA requires a 60-day QLE window to notify ERS if the following:

1. If the dependent is not in the GBP and loses their eligibility for Medicaid or CHIP OR

2. If the dependent is not in the GBP and they become eligible for premium assistance through Medicaid or HIPP they have 60 days to enroll in the GBP.

DROP DEPENDENT COVERAGE INFORMATION:

In other QLE instances related to Medicaid or CHIP there is the usual 30 day window to drop dependents from the GBP.

** Employees must contact their benefits coordinator (HHS Enterprise employees contact HHS Employee Service Center) to drop dependent(s) added with a National Medical

Support Notice (NMSN).

You may be asked to show proof of the QLE and will be required to submit documentation for newly enrolled dependents, proving their eligibility.

Employees Retirement System of Texas PO Box 13207 Austin, Texas 78711-3207 (877) 275-4377

ERS GI-1.180 (R 6/2016) (Page 3 of 3)

1

1 2

2 3

3