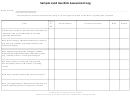

Sample Bank Bsa/aml Bank Risk Assessment Page 2

ADVERTISEMENT

High Risk

Moderate Risk

Low Risk

Rating

Comments

Scored as “3”

Scored as “2”

Scored as “1”

Score

Wide array of ACH services

including international cross-border

transactions (IAT), high volume

Limited international ACH

Primarily domestic ACH transaction

online ACH origination by corporate

transactions (IAT) and low volume

activity in customer accounts with

Measured by comparing the total IAT

14

customers (>15% of customers), and

online ACH origination (<15% of

regular automated OFAC screening

1

transactions against total ACH

non-bank Internet based and third

customers but >5%) with regular

and low volume of customer ACH

transactions

party service provider originated

automated OFAC screening

origination (<5% of customers)

ACH transactions with limited

automated OFAC screening

Institution sells a large volume of

Institution sells a large number of

Institution sells a low volume or does

stored value cards with limited

Analyze stored value card sale activity for

15

stored value cards with no

not offer these types of stored value

1

restrictions (100 to 500 cards per

the past 12 months

restrictions (> 500 cards per year)

cards (<100 cards per year)

year)

Significant number of Internet

Minimal number of Internet gambling

gambling business customers with

business customers with legal

Certification by all commercial

legal documentation and certification

documentation and certification by

customers that no Internet gambling

16

by all other commercial customers

all other commercial customers that

1

business transactions are conducted

that no Internet gambling business

no Internet gambling business

(0 customers)

transactions are conducted (>5

transactions are conducted (< 5

customers)

customers)

Large amount of brokered deposits

(>15% of total deposits) from a wide

Moderate level of brokered deposits

variety of brokers, some of which

Less than 5% of total deposits are

(<15% but >5% of total deposits)

Measured by comparing total brokered

17

may not be as well known to bank

brokered deposits from a few well

1

from a few well known low risk

deposits to total bank deposits

and could offer other high risk

known low risk brokers

brokers

services such as establishing shell

companies in high risk geographies

Bank offers nondeposit investment

products (NDIP) and insurance

Moderate level of traditional NDIP

involving complex legal

No NDIP or insurance services

and insurance services with low risk

Analyze NDIP sales activity over the last

18

arrangements, rapidly moving large

offered by the bank (< 2% of our

2

regional partner

12 months

dollars, and portfolios controlled

customers)

(< 5% but > 2% of our customers)

directly by clients (>5% of our

customers)

More than 15% but less than 30% of

Less than 15% of new accounts are

More than 30% of new accounts are

new accounts are opened via

opened via Internet, mail or

Compare total new accounts opened via

19

opened via Internet, mail or

Internet, mail or telephone without

telephone without prior relationship,

1

the Internet to total new accounts over the

telephone without prior relationship

prior relationship, such that majority

such that vast majority of accounts

past 12 months

of accounts still opened in-person

still opened in-person

Highly diverse metropolitan area or

Rural homogenous community bank

Bank located in money center with

university located nearby more than

with less than 25% of branches in

20

more than 50% of branches located

1

Analyze branch geographical dispersion

25% of branches but less than 50%

higher risk metropolitan or US border

on a US border

of branches

areas

No aggregate cash reporting system

Automated aggregate cash reporting

Aggregated cash reporting system

21

or Anti-Money Laundering (AML)

system but no AML monitoring

1

and AML monitoring software

and fraud monitoring software

software

No centralized Suspicious Activity

Centralized SAR monitoring and

Centralized SAR monitoring with

22

Report (SAR) monitoring or well

reporting with an internal referral

2

formalized internal referral system

documented internal referral system

system

More than 20 suspicious activity

23

10 to 19 SARs filed per year

Fewer than 10 SARs per year

1

reports (SARs) filed per year

Inadequate BSA/AML training

Adequate BSA/AML training

Comprehensive BSA/AML and SAR

24

program on less than an annual

including SAR program on at least

training program with regular

1

basis

an annual basis

updates throughout the year

Low turnover of key personnel (15%

High turnover (more than 15%), in

Low turnover in key positions (15%

or less), but frontline personnel in

key BSA/AML and SAR personnel

or less) and frontline personnel in

25

branches has changed significantly

2

positions and/or more than 25%

branches has not changed

(more than 10% but less than 25%

turnover in frontline personnel

significantly (10% or less turnover)

employees)

Overall Bank Secrecy Act and Anti-Money Laundering Risk Assessment Score

31

High (61 to 75)

Moderate (41 to 60)

Low (25 to 40)

* HIDTA/HIFCA – High Intensity Drug Trafficking Area and High Intensity Financial Crime Area

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2