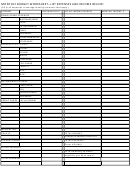

Monthly Budget Worksheet Template With Instructions

ADVERTISEMENT

INSTRUCTIONS FOR HOW TO CREATE A BUDGET

STEP 1

Print out three copies of a budget worksheet.

STEP 2

Look over the categories of spending

listed on the printable worksheet and brainstorm any additional categories

in which you spend. Reviewing your receipts, bank account statement, checkbook register or credit card bill from the

past month may help you think of additional categories. For example, you might have child care expenses, charitable

giving and a gym membership that don't t into any categories listed on the worksheet. Add these categories to the

worksheet.

STEP 3

Record your net income

in the section of the worksheet that asks for your income. Your net income is the amount you

actually get in your paychecks, not the base pay before taxes, withholding and other deductions. If you get paid every

other week, you may either multiply your paycheck by 2.17 to calculate your average monthly pay or base your budget on

two paychecks per month so you can use the extra paycheck however you want in the months when you get three checks.

STEP 4

Fill in the monthly amount for your regular expenses,

using recent bills to guide you. Record the high amount, not the

average, on bills that uctuate every month. For example, with your electricity bill, don't record a spring or fall bill as your

monthly amount because the bill is typically higher during the seasons when you need heat or air conditioning. If you

record the high amount, you ensure that you have enough money budgeted for your bill each month.

STEP 5

Use your credit card bills, checking account statements or checkbook to estimate

how much you spend per month in

categories that don't have xed expenses. These include groceries, eating out, entertainment, gifts, gas and clothing.

If you haven't kept track of these before, make your best guess for how much you'd like to spend in each category.

STEP 6

Make a list of bills that you don't pay every month.

These may include magazine or newspaper subscriptions, car

registration, holiday gifts, vacations and certain types of insurance. Estimate your annual total in each category, divide

that total by 12 and enter that amount on your monthly budgeting worksheet. That way, you're putting money aside

every month for these annual expenses.

STEP 7

Add up your total expenses and compare them to your total income.

If your expenses are less than your income, you

have a working budget --- you may put the remainder of your income into savings. If your income is less than your

expenses, you need to adjust the budget to make it balance. Do this by cutting the amount you plan to spend in

exible categories, such as eating out.

STEP 8

Keep an itemized log of all of your expenses for a full month

after lling out the budget worksheet. This includes

everything from your mortgage payment to the candy bar you bought from a vending machine. At the end of the

month, ll out a blank printable budget worksheet with your actual numbers for that month.

STEP 9

Compare your actual budget to the budget you planned.

Pay special attention to whether there were categories in

which you spent more than you planned. If so, either make a plan on how you'll cut spending in that category next

month to match your original budget, or make a new budget that allows increased spending in that category by

decreasing your spending in another category.

Securities o ered through LPL Financial. Member FINRA (www. ) and SIPC ( ).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2