Mortgage Loan Application Form

ADVERTISEMENT

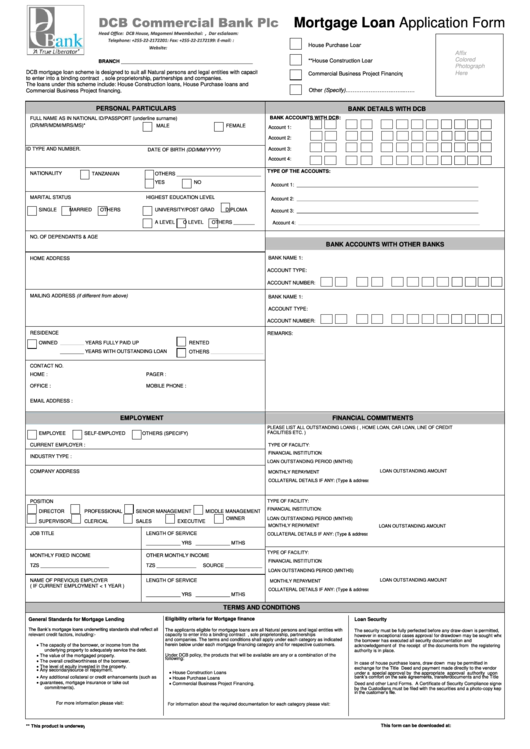

DCB Commercial Bank Plc

Mortgage Loan Application Form

Head Office: DCB House, Magomeni Mwembechai: P.O. BOX 19798, Dar es Salaam:

Telephone: +255-22-2172201: Fax: +255-22-2172199: E-mail:info@dcb.co.tz:

House Purchase Loan

Website:

Affix

Colored

**House Construction Loan

BRANCH __________________________________________________

Photograph

DCB mortgage loan scheme is designed to suit all Natural persons and legal entities with capacity

Here

Commercial Business Project Financing

to enter into a binding contract i.e. individuals, sole proprietorship, partnerships and companies.

The loans under this scheme include: House Construction loans, House Purchase loans and

Commercial Business Project financing.

Other (Specify).…………………………..……

PERSONAL PARTICULARS

BANK DETAILS WITH DCB

BANK ACCOUNTS WITH DCB:

FULL NAME AS IN NATIONAL ID/PASSPORT (underline surname)

(DR/MR/MDM/MRS/MS)*

MALE

FEMALE

Account 1:

Account 2:

ID TYPE AND NUMBER.

Account 3:

DATE OF BIRTH (DD/MM/YYYY)

Account 4:

TYPE OF THE ACCOUNTS:

NATIONALITY

TANZANIAN

OTHERS ________________________________

YES

NO

Account 1: _____________________________________________________________________

MARITAL STATUS

HIGHEST EDUCATION LEVEL

Account 2: _____________________________________________________________________

SINGLE

MARRIED

OTHERS

UNIVERSITY/POST GRAD

DIPLOMA

Account 3: _____________________________________________________________________

A LEVEL

O LEVEL

OTHERS ________

Account 4: _____________________________________________________________________

NO. OF DEPENDANTS & AGE

BANK ACCOUNTS WITH OTHER BANKS

BANK NAME 1:

HOME ADDRESS

ACCOUNT TYPE:

ACCOUNT NUMBER:

MAILING ADDRESS (if different from above)

BANK NAME 1:

ACCOUNT TYPE:

ACCOUNT NUMBER:

RESIDENCE

REMARKS:

OWNED _________ YEARS FULLY PAID UP

RENTED

_________ YEARS WITH OUTSTANDING LOAN

OTHERS ____________________

CONTACT NO.

HOME :

PAGER :

OFFICE :

MOBILE PHONE :

EMAIL ADDRESS :

EMPLOYMENT

FINANCIAL COMMITMENTS

PLEASE LIST ALL OUTSTANDING LOANS (E.G. SALARIED LOAN, HOME LOAN, CAR LOAN, LINE OF CREDIT

FACILITIES ETC. )

EMPLOYEE

SELF-EMPLOYED

OTHERS (SPECIFY)

CURRENT EMPLOYER :

TYPE OF FACILITY:

FINANCIAL INSTITUTION:

INDUSTRY TYPE :

LOAN OUTSTANDING PERIOD (MNTHS):

COMPANY ADDRESS

LOAN OUTSTANDING AMOUNT:

MONTHLY REPAYMENT:

COLLATERAL DETAILS IF ANY: (Type & address)

TYPE OF FACILITY:

POSITION

FINANCIAL INSTITUTION:

DIRECTOR

PROFESSIONAL

SENIOR MANAGEMENT

MIDDLE MANAGEMENT

OWNER

LOAN OUTSTANDING PERIOD (MNTHS):

SUPERVISOR

CLERICAL

SALES

EXECUTIVE

MONTHLY REPAYMENT:

LOAN OUTSTANDING AMOUNT:

JOB TITLE

LENGTH OF SERVICE

COLLATERAL DETAILS IF ANY: (Type & address)

_____________ YRS _____________ MTHS

TYPE OF FACILITY:

MONTHLY FIXED INCOME

OTHER MONTHLY INCOME

FINANCIAL INSTITUTION:

TZS __________________________

TZS _______________

SOURCE ______________

LOAN OUTSTANDING PERIOD (MNTHS):

LOAN OUTSTANDING AMOUNT:

NAME OF PREVIOUS EMPLOYER

LENGTH OF SERVICE

MONTHLY REPAYMENT:

( IF CURRENT EMPLOYMENT < 1 YEAR )

COLLATERAL DETAILS IF ANY: (Type & address)

_____________ YRS _____________ MTHS

TERMS AND CONDITIONS

Eligibility criteria for Mortgage finance

General Standards for Mortgage Lending

Loan Security

The Bank’s mortgage loans underwriting standards shall reflect all

The applicants eligible for mortgage loans are all Natural persons and legal entities with

The security must be fully perfected before any draw-down is permitted,

relevant credit factors, including:-

capacity to enter into a binding contract i.e. individuals, sole proprietorship, partnerships

however in exceptional cases approval for drawdown may be sought when

and companies. The terms and conditions shall apply under each category as indicated

the

borrower

has

executed

all

security

documentation

and

The capacity of the borrower, or income from the

herein below under each mortgage financing category and for respective customers.

acknowledgement of the receipt of the documents from the registering

underlying property to adequately service the debt.

authority is in place.

The value of the mortgaged property.

Under DCB policy, the products that will be available are any or a combination of the

following:

The overall creditworthiness of the borrower.

In case of house purchase loans, draw down may be permitted in

The level of equity invested in the property.

exchange for the Title Deed and payment made directly to the vendor

Any secondary source of repayment.

House Construction Loans

under a special approval by the appropriate approval authority upon

Any additional collateral or credit enhancements (such as

bank’s comfort on the sale agreements, transfer documents and the Title

House Purchase Loans

guarantees,

mortgage

insurance

or

take

out

Commercial Business Project Financing.

Deed and other Land Forms. A Certificate of Security Compliance signed

commitments).

by the Custodians must be filed with the securities and a photo-copy kept

in the customer’s file.

For more information please visit:

For information about the required documentation for each category please visit:

This form can be downloaded at:

** This product is underway

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2