Income Verification Form

ADVERTISEMENT

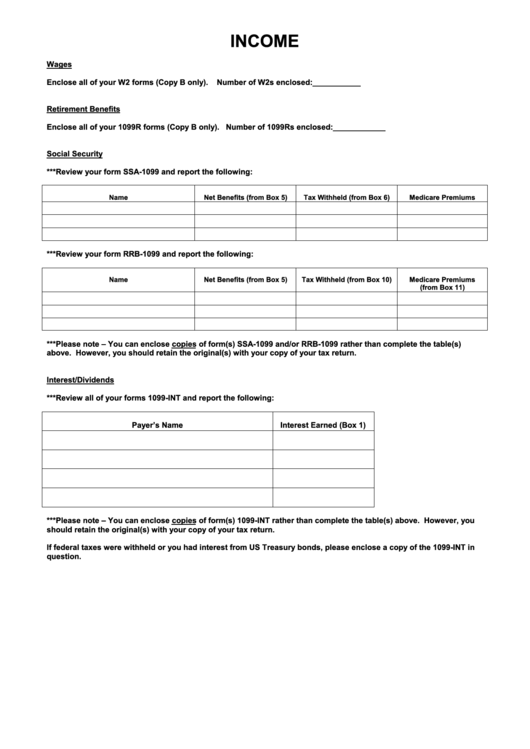

INCOME

Wages

Enclose all of your W2 forms (Copy B only).

Number of W2s enclosed:___________

Retirement Benefits

Enclose all of your 1099R forms (Copy B only). Number of 1099Rs enclosed:____________

Social Security

***Review your form SSA-1099 and report the following:

Name

Net Benefits (from Box 5)

Tax Withheld (from Box 6)

Medicare Premiums

***Review your form RRB-1099 and report the following:

Name

Net Benefits (from Box 5)

Tax Withheld (from Box 10)

Medicare Premiums

(from Box 11)

***Please note – You can enclose copies of form(s) SSA-1099 and/or RRB-1099 rather than complete the table(s)

above. However, you should retain the original(s) with your copy of your tax return.

Interest/Dividends

***Review all of your forms 1099-INT and report the following:

Payer’s Name

Interest Earned (Box 1)

***Please note – You can enclose copies of form(s) 1099-INT rather than complete the table(s) above. However, you

should retain the original(s) with your copy of your tax return.

If federal taxes were withheld or you had interest from US Treasury bonds, please enclose a copy of the 1099-INT in

question.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2