Family Share Tuition Worksheet

ADVERTISEMENT

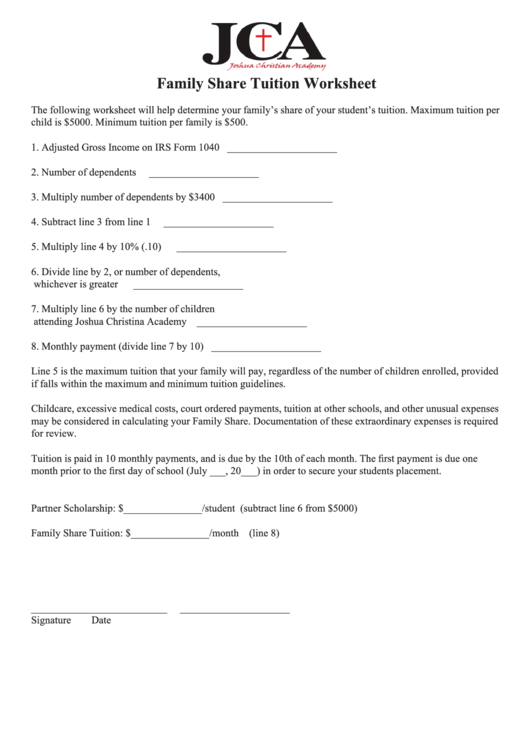

Family Share Tuition Worksheet

The following worksheet will help determine your family’s share of your student’s tuition. Maximum tuition per

child is $5000. Minimum tuition per family is $500.

1.

Adjusted Gross Income on IRS Form 1040

_____________________

2.

Number of dependents

_____________________

3.

Multiply number of dependents by $3400

_____________________

4.

Subtract line 3 from line 1

_____________________

5.

Multiply line 4 by 10% (.10)

_____________________

6.

Divide line by 2, or number of dependents,

whichever is greater

_____________________

7.

Multiply line 6 by the number of children

attending Joshua Christina Academy

_____________________

8.

Monthly payment (divide line 7 by 10)

_____________________

Line 5 is the maximum tuition that your family will pay, regardless of the number of children enrolled, provided

if falls within the maximum and minimum tuition guidelines.

Childcare, excessive medical costs, court ordered payments, tuition at other schools, and other unusual expenses

may be considered in calculating your Family Share. Documentation of these extraordinary expenses is required

for review.

Tuition is paid in 10 monthly payments, and is due by the 10th of each month. The first payment is due one

month prior to the first day of school (July ___, 20___) in order to secure your students placement.

Partner Scholarship: $_______________/student (subtract line 6 from $5000)

Family Share Tuition: $_______________/month (line 8)

__________________________

_____________________

Signature

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3