Clear Form

Print Form

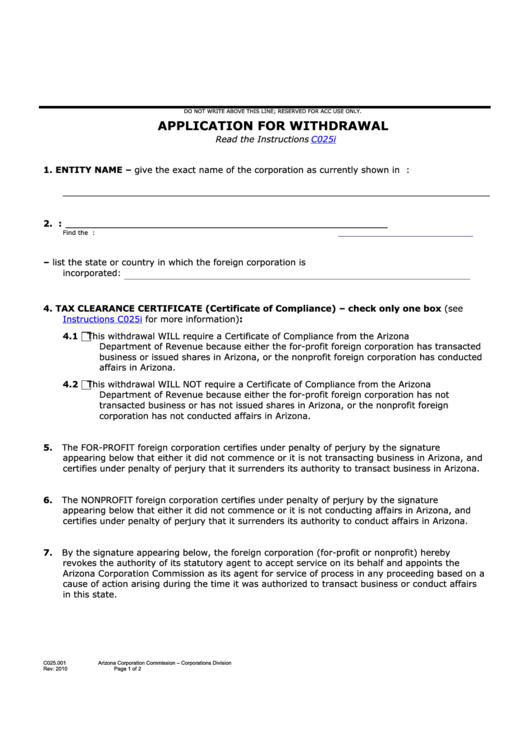

DO NOT WRITE ABOVE THIS LINE; RESERVED FOR ACC USE ONLY.

APPLICATION FOR WITHDRAWAL

Read the Instructions

C025i

1.

ENTITY NAME – give the exact name of the corporation as currently shown in A.C.C. records:

_________________________________________________________________

_________________________________________________

2.

A.C.C. FILE NUMBER:

Find the A.C.C. file number on the upper corner of filed documents OR on our website at:

3.

FOREIGN DOMICILE – list the state or country in which the foreign corporation is

incorporated:

______________________________________________________________________________________________________________________________________________________________

4.

TAX CLEARANCE CERTIFICATE (Certificate of Compliance) – check only one box (see

Instructions C025i

for more information):

4.1

This withdrawal WILL require a Certificate of Compliance from the Arizona

Department of Revenue because either the for-profit foreign corporation has transacted

business or issued shares in Arizona, or the nonprofit foreign corporation has conducted

affairs in Arizona.

4.2

This withdrawal WILL NOT require a Certificate of Compliance from the Arizona

Department of Revenue because either the for-profit foreign corporation has not

transacted business or has not issued shares in Arizona, or the nonprofit foreign

corporation has not conducted affairs in Arizona.

5.

The FOR-PROFIT foreign corporation certifies under penalty of perjury by the signature

appearing below that either it did not commence or it is not transacting business in Arizona, and

certifies under penalty of perjury that it surrenders its authority to transact business in Arizona.

6.

The NONPROFIT foreign corporation certifies under penalty of perjury by the signature

appearing below that either it did not commence or it is not conducting affairs in Arizona, and

certifies under penalty of perjury that it surrenders its authority to conduct affairs in Arizona.

7.

By the signature appearing below, the foreign corporation (for-profit or nonprofit) hereby

revokes the authority of its statutory agent to accept service on its behalf and appoints the

Arizona Corporation Commission as its agent for service of process in any proceeding based on a

cause of action arising during the time it was authorized to transact business or conduct affairs

in this state.

C025.001

Arizona Corporation Commission – Corporations Division

Rev: 2010

Page 1 of 2

1

1 2

2