Property Tax Credit - Renewable Energy Application Form - Division Of Treasury, Montgomery County

ADVERTISEMENT

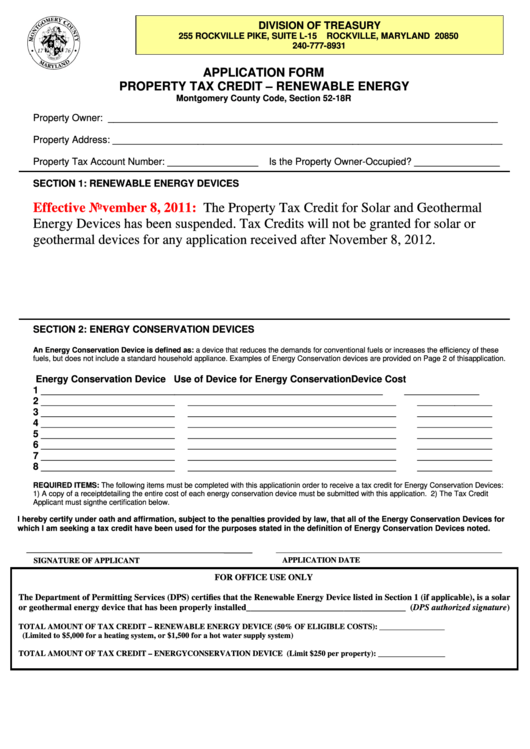

DIVISION OF TREASURY

255 ROCKVILLE PIKE, SUITE L-15

ROCKVILLE, MARYLAND 20850

240-777-8931

APPLICATION FORM

PROPERTY TAX CREDIT – RENEWABLE ENERGY

Montgomery County Code, Section 52-18R

Property Owner: _________________________________________________________________________

Property Address: _________________________________________________________________________

Property Tax Account Number: _________________

Is the Property Owner-Occupied? ________________

SECTION 1: RENEWABLE ENERGY DEVICES

Effective November 8, 2011:

The Property Tax Credit for Solar and Geothermal

Energy Devices has been suspended. Tax Credits will not be granted for solar or

geothermal devices for any application received after November 8, 2012.

SECTION 2: ENERGY CONSERVATION DEVICES

An Energy Conservation Device is defined as: a device that reduces the demands for conventional fuels or increases the efficiency of these

fuels, but does not include a standard household appliance. Examples of Energy Conservation devices are provided on Page 2 of this application.

Energy Conservation Device

Use of Device for Energy Conservation

Device Cost

1

_________________________

_______________________________________

______________

2

_________________________

_______________________________________

______________

3

_________________________

_______________________________________

______________

4

_________________________

_______________________________________

______________

5

_________________________

_______________________________________

______________

6

_________________________

_______________________________________

______________

7

_________________________

_______________________________________

______________

8

_________________________

_______________________________________

______________

REQUIRED ITEMS: The following items must be completed with this application in order to receive a tax credit for Energy Conservation Devices:

1) A copy of a receipt detailing the entire cost of each energy conservation device must be submitted with this application. 2) The Tax Credit

Applicant must sign the certification below.

I hereby certify under oath and affirmation, subject to the penalties provided by law, that all of the Energy Conservation Devices for

which I am seeking a tax credit have been used for the purposes stated in the definition of Energy Conservation Devices noted.

APPLICATION DATE

SIGNATURE OF APPLICANT

FOR OFFICE USE ONLY

The Department of Permitting Services (DPS) certifies that the Renewable Energy Device listed in Section 1 (if applicable), is a solar

or geothermal energy device that has been properly installed____________________________________ (DPS authorized signature)

TOTAL AMOUNT OF TAX CREDIT – RENEWABLE ENERGY DEVICE (50% OF ELIGIBLE COSTS): _________________

(Limited to $5,000 for a heating system, or $1,500 for a hot water supply system)

TOTAL AMOUNT OF TAX CREDIT – ENERGY CONSERVATION DEVICE (Limit $250 per property): _________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2