FULL NAME (last, first, middle)_________________________________

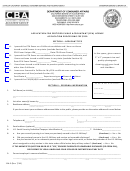

APPLICATION FOR CPA LICENSE

PAGE 2 OF 2

□

□

10.

Have you ever applied for a CPA license with the CBA? (check one)

Yes

No

11.

Have you ever had a professional or vocational license, permit, certificate or registration disciplined, or received any other

form of enforcement action by this or any other state, agency of the federal government, or a foreign country? (check

□

□

one)

Yes

No

12.

Have you ever been cited or sanctioned for unlawfully engaging in the practice of public accountancy in another state?

□

□

(check one)

Yes

No

IF THE ANSWER TO QUESTION 11 OR 12 IS “YES,” PROVIDE A DETAILED EXPLANATION USING A SEPARATE SHEET OF PAPER.

SECTION III – OUT-OF-STATE LICENSEE INFORMATION

13.

In which state(s) were you issued a CPA or PA license, permit, certificate or registration?______________________________

CPA certificate/license #(s)_________________________Date(s) CPA certificate/license issued_________________________

□

□

14.

Have you held an active license to practice public accountancy for at least four of the last ten years? (check one)

Yes

No

SECTION IV – EDUCATION

List below all schools attended after high school for which you will have an official transcript

DEGREE OBTAINED?

submitted. Foreign education must be evaluated by a CBA-approved foreign credentials evaluation

YES

NO

service provider and submitted directly to the CBA.

SECTION V – EXPERIENCE

□

□

15.

I am applying for CPA licensure with (check one):

General Accounting Experience

Attest Experience (requires 500

attest hours documented on a Certificate of Attest Experience Form )

List below in chronological order, all public and nonpublic experience for which you will have a Certificate of Experience form

submitted. You are responsible for providing each supervisor with a Certificate of Experience form for completion. The supervisor

must return the Certificate of Experience form directly to the CBA.

POSITION

DATES

EMPLOYER

PUBLIC (P)

MAILING ADDRESS

FROM

TO

PRIVATE INDUSTRY (PI)

GOVERNMENT (G)

ACADEMIA (A)

OUT-OF-STATE CPA LICENSEES ONLY: For self employment experience, submit a schedule listing the following information: (1)

Clients’ names and addresses (2) Brief description of services rendered to the client (3) Dates services performed.

SECTION VI – CERTIFIED TRUE STATEMENT

I hereby certify, under penalty of perjury, under all laws of the state of California that all statements, answers and representations on

this form, and all attachments, are true, complete, and accurate.

Date___________________________________

Signature__________________________________________________

By submitting this application for CPA licensure, you are acknowledging that you have read and understand the Rules of Professional Conduct

adopted by the CBA. Reference California Business and Professions Code, Chapter 1 of Division 3, Article 3.5 (starting at section 5060) and

California Code of Regulations Title 16, Division 1, Article 9 (starting at section 50).

RESET

1

1 2

2 3

3