Save

Print

Clear

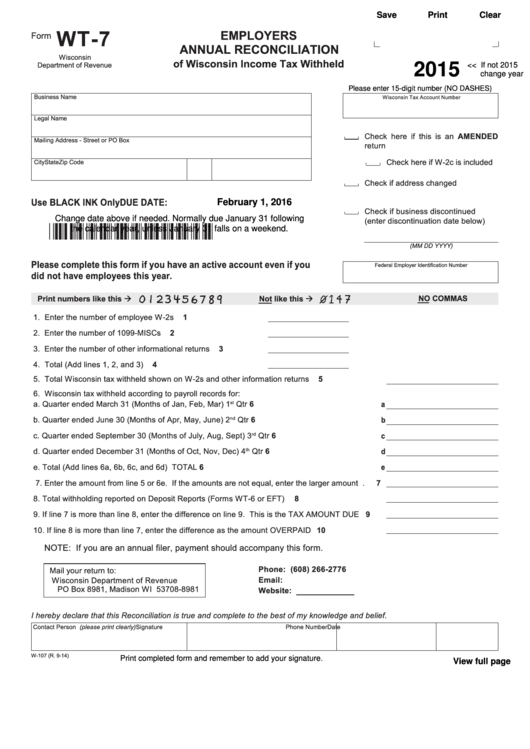

WT-7

EMPLOYERS

Form

ANNUAL RECONCILIATION

Wisconsin

of Wisconsin Income Tax Withheld

Department of Revenue

2015

<< If not 2015

change year

Please enter 15-digit number (NO DASHES)

Business Name

Wisconsin Tax Account Number

Legal Name

Check here if this is an AMENDED

Mailing Address - Street or PO Box

return

Check here if W-2c is included

City

State

Zip Code

Check if address changed

Use BLACK INK Only

DUE DATE:

February 1, 2016

Check if business discontinued

Change date above if needed. Normally due January 31 following

(enter discontinuation date below)

the calendar year, unless January 31 falls on a weekend.

(MM DD YYYY)

Please complete this form if you have an active account even if you

Federal Employer Identification Number

did not have employees this year.

NO COMMAS

Print numbers like this

Not like this

1. Enter the number of employee W-2s . . . . . . . . . . . . . . . . .

1

2. Enter the number of 1099-MISCs . . . . . . . . . . . . . . . . . . .

2

3

3. Enter the number of other informational returns . . . . . . . .

4. Total (Add lines 1, 2, and 3) . . . . . . . . . . . . . . . . . . . . . . . .

4

5. Total Wisconsin tax withheld shown on W-2s and other information returns . . . . . . . . . . . .

5

6. Wisconsin tax withheld according to payroll records for:

a. Quarter ended March 31 (Months of Jan, Feb, Mar) . . . . . . . . . . . . . . . . . . . . . . . 1

Qtr 6a

st

b. Quarter ended June 30 (Months of Apr, May, June) . . . . . . . . . . . . . . . . . . . . . . .2

Qtr 6b

nd

Qtr 6c

c. Quarter ended September 30 (Months of July, Aug, Sept) . . . . . . . . . . . . . . . . . . 3

rd

d. Quarter ended December 31 (Months of Oct, Nov, Dec) . . . . . . . . . . . . . . . . . . . . 4

Qtr 6d

th

e. Total (Add lines 6a, 6b, 6c, and 6d) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . TOTAL 6e

7. Enter the amount from line 5 or 6e. If the amounts are not equal, enter the larger amount .

7

8

8. Total withholding reported on Deposit Reports (Forms WT-6 or EFT) . . . . . . . . . . . . . . . . .

9. If line 7 is more than line 8, enter the difference on line 9. This is the TAX AMOUNT DUE

9

10. If line 8 is more than line 7, enter the difference as the amount OVERPAID . . . . . . . . . . . . . 10

NOTE: If you are an annual filer, payment should accompany this form.

Phone: (608) 266-2776

Mail your return to:

Email: dorwithholdingtax@revenue.wi.gov

Wisconsin Department of Revenue

PO Box 8981, Madison WI 53708-8981

Website: revenue.wi.gov

I hereby declare that this Reconciliation is true and complete to the best of my knowledge and belief.

Contact Person (please print clearly)

Signature

Phone Number

Date

W-107 (R. 9-14)

Print completed form and remember to add your signature.

View full page

1

1