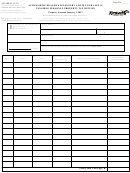

Personal Property Listing Form - 2017 Page 3

ADVERTISEMENT

2017 INSTRUCTIONS FOR FILING STANLY COUNTY INDIVIDUAL PROPERTY TAX LISTING

Please complete this form and return it to the STANLY COUNTY TAX OFFICE

by January 31, 2017 to avoid a mandatory 10% lis ng penalty.

If you need assistance with this form, please contact the Stanly County Tax Offi ce at (704) 986-3626 or visit our offi ce located at 201

South 2

nd

Street, 2

nd

Floor, Albemarle, NC between the hours of 8:30 AM and 5:00 PM, Monday – Friday.

Stanly County is on a permanent real estate lis ng system. Real estate property owners are no longer required to list their land

and buildings on an annual basis, but any improvements made to the property must be listed in January, along with all types of

personal property. Failure to report such property will result in a late lis ng penalty equal to 10% of the amount of the tax.

TYPES OF PROPERTY THAT MUST BE LISTED

A permanent lis ng system does not aff ect the lis ng of personal property. All motor vehicles with a current annual North Carolina

tag and registra on are not to be listed. However, any unregistered or mul -year/permanently tagged vehicles and trailers, along

with watercra and motors, personal property manufactured housing, aircra , business equipment and farm equipment must be

listed annually. Lis ng forms will be mailed to taxpayers who reported these types of assets the previous year.

IT IS STILL THE DUTY OF REAL PROPERTY OWNERS TO REPORT ANY IMPROVEMENTS MADE TO REAL PROPERTY. Such improvements

may include but are not limited to: building a deck, fi nishing a basement, adding a porch, carport, garage, barn, pier or dock, or

storage building. Failure to report these improvements may result in penal es. Rou ne repairs and maintenance such as pain ng,

replacing carpet, roof repairs, replacement of fi xtures, and other similar improvements need not be reported.

ST

PLEASE REPORT ANY STRUCTURES WHICH HAVE BEEN REMOVED OR DESTROYED SINCE LAST JANUARY 1

.

A. Verify your name and mailing address, making correc ons as needed.

B. Complete the personal data sec on.

C. Note any real estate changes made since January 1, 2016.

D. Review the preprinted property listed and assessed last year and make necessary changes refl ec ve as of JANUARY 1,

2017. Add any missing informa on and addi onal items owned as of January 1

st

. Provide the physical address of the

property.

E.

List number of dogs that you own.

F.

Read, sign & date the affi rma on as owner. Unsigned forms will be returned for signature, subjec ng them to possible

late lis ng penal es.

G. Personal property inside apartments and houses is taxable if used for the produc on of income and must be reported on

a business lis ng form. Contact (704) 986-3628 or go to if a form is needed.

H. Farm equipment used for the production of income must be reported on a business listing form. Contact (704) 986-

3628 or go to if a form is needed.

I.

Present Use Value Program (G.S. #105-277.3) – Land parcels presently used for agricultural, hor cultural, or forestland

may be considered for qualifi ca on if the applica on is made during the regular lis ng period in January, or within thirty

days from date of value change. Landowners already receiving this deferment must no fy the tax assessor of any changes

in (1) USE, (2) ACREAGE, or (3) OWNERSHIP to avoid penal es. Call (704) 986-3630 if you have ques ons.

SEE THE BACK OF THE PERSONAL PROPERTY LISTING FORM FOR INFORMATION CONCERNING THE PROPERTY TAX HOMESTEAD

EXCLUSION FOR THE ELDERLY OR DISABLED, THE CIRCUIT BREAKER DEFERMENT, AND THE DISABLED VETERANS EXCLUSION.

GENERAL INFORMATION

North Carolina state law requires all property be assessed at 100% of true market value as of January 1

st

.

All taxable personal property, except vehicles with a current annual NC tag & registra on, must be listed each year in

January.

Lis ng forms submi ed by mail will be considered fi led as of the date shown on the postmark affi xed by the U S Postal

Service. If no postmark is shown, the lis ng will be considered fi led when received by the tax offi ce.

Audits of selected individual and business property records will be conducted rou nely to ensure lis ng compliance and

promote equity among taxpayers in Stanly County.

Any individual who willfully makes and subscribes an abstract lis ng required by Subchapter II, which he does not believe

to be true and correct as to every material ma er, shall be guilty of a Class 2 misdemeanor, punishable by a fi ne not to

exceed $1,000 and/or imprisonment up to 60 days.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3