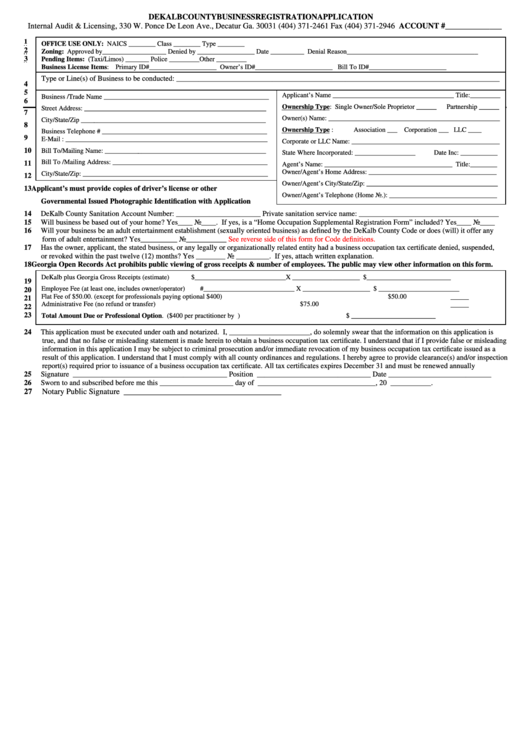

Dekalb County Business Registration Application

ADVERTISEMENT

DEKALB COUNTY BUSINESS REGISTRATION APPLICATION

Internal Audit & Licensing, 330 W. Ponce De Leon Ave., Decatur Ga. 30031 (404) 371-2461 Fax (404) 371-2946 ACCOUNT #______________

1

OFFICE USE ONLY:

NAICS ________ Class ________ Type ________ H.O.P. ________ District ________ Lot ________ Block ______ Parcel _______

2

Zoning:

Approved by___________________ Denied by _________________ Date __________ Denial Reason_______________________________________

3

Pending Items: C.O. ___ Fire ____ Health ____ Sanitation Service _____ State License _______ Insurance (Taxi/Limos) _______ Police _________ Other _________

Business License Items: Primary ID#____________________ Owner’s ID#_______________________ Bill To ID#_______________________

Type or Line(s) of Business to be conducted: ________________________________________________________________________________________

4

5

Applicant’s Name ____________________________________ Title:_________

Business /Trade Name _________________________________________________

6

Ownership Type: Single Owner/Sole Proprietor ______

Partnership ______

Street Address: ______________________________________________________

7

Owner(s) Name: ___________________________________________________

City/State/Zip _______________________________________________________

8

Ownership Type :

Association ___ Corporation ___ LLC ____

Business Telephone # _________________________________________________

9

E-Mail : ____________________________________________________________

Corporate or LLC Name: ____________________________________________

10

Bill To/Mailing Name: ________________________________________________

State Where Incorporated: __________________

Date Inc: ___________

Bill To /Mailing Address: ______________________________________________

11

Agent’s Name: ______________________________________ Title:________

Owner/Agent’s Home Address: ______________________________________

City/State/Zip: _______________________________________________________

12

Owner/Agent’s City/State/Zip: _______________________________________

13

Applicant’s must provide copies of driver’s license or other

Owner/Agent’s Telephone (Home No.): ________________________________

Governmental Issued Photographic Identification with Application

14

DeKalb County Sanitation Account Number: _______________________ Private sanitation service name: ______________________________________

15

Will business be based out of your home? Yes____ No____. If yes, is a “Home Occupation Supplemental Registration Form” included? Yes____ No____

16

Will your business be an adult entertainment establishment (sexually oriented business) as defined by the DeKalb County Code or does (will) it offer any

form of adult entertainment? Yes__________ No___________

See reverse side of this form for Code definitions.

17

Has the owner, applicant, the stated business, or any legally or organizationally related entity had a business occupation tax certificate denied, suspended,

or revoked within the past twelve (12) months? Yes ________ No _________. If yes, attach written explanation.

18

Georgia Open Records Act prohibits public viewing of gross receipts & number of employees. The public may view other information on this form.

DeKalb plus Georgia Gross Receipts (estimate)

$___________________________X ____________________

$_________________________

19

Employee Fee (at least one, includes owner/operator)

#___________________________ X ____________________

$ ________________________

20

Flat Fee of $50.00. (except for professionals paying optional $400)

$50.00

21

Administrative Fee (no refund or transfer)

$75.00

22

23

Total Amount Due or Professional Option. ($400 per practitioner by O.C.G.A.)

$ _________________________

24

This application must be executed under oath and notarized. I, ______________________, do solemnly swear that the information on this application is

true, and that no false or misleading statement is made herein to obtain a business occupation tax certificate. I understand that if I provide false or misleading

information in this application I may be subject to criminal prosecution and/or immediate revocation of my business occupation tax certificate issued as a

result of this application. I understand that I must comply with all county ordinances and regulations. I hereby agree to provide clearance(s) and/or inspection

report(s) required prior to issuance of a business occupation tax certificate. All tax certificates expires December 31 and must be renewed annually

25

Signature __________________________________________ Position _______________________________ Date ____________________________

26

Sworn to and subscribed before me this ____________________ day of ________________________________, 20 ___________.

27

Notary Public Signature _______________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Life

1

1