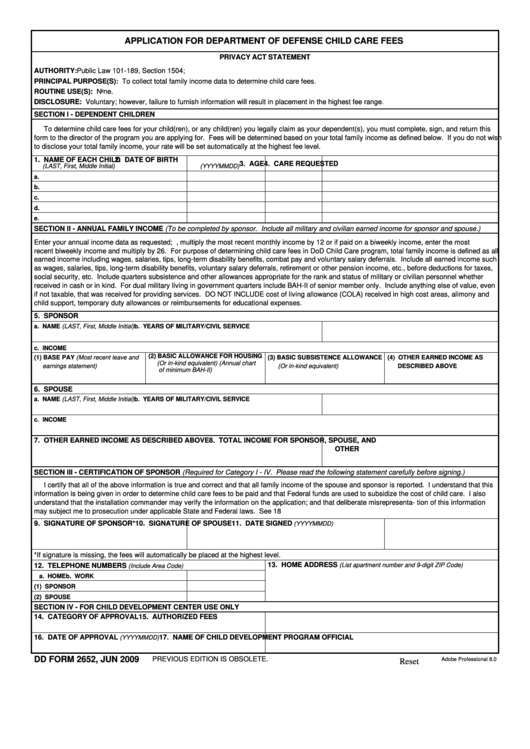

APPLICATION FOR DEPARTMENT OF DEFENSE CHILD CARE FEES

PRIVACY ACT STATEMENT

AUTHORITY: Public Law 101-189, Section 1504; E.O. 9397.

PRINCIPAL PURPOSE(S): To collect total family income data to determine child care fees.

ROUTINE USE(S): None.

DISCLOSURE: Voluntary; however, failure to furnish information will result in placement in the highest fee range.

SECTION I - DEPENDENT CHILDREN

To determine child care fees for your child(ren), or any child(ren) you legally claim as your dependent(s), you must complete, sign, and return this

form to the director of the program you are applying for. Fees will be determined based on your total family income as defined below. If you do not wish

to disclose your total family income, your rate will be set automatically at the highest fee level.

1. NAME OF EACH CHILD

2. DATE OF BIRTH

3. AGE

4. CARE REQUESTED

(LAST, First, Middle Initial)

(YYYYMMDD)

a.

b.

c.

d.

e.

SECTION II - ANNUAL FAMILY INCOME (To be completed by sponsor. Include all military and civilian earned income for sponsor and spouse.)

Enter your annual income data as requested; e.g., multiply the most recent monthly income by 12 or if paid on a biweekly income, enter the most

recent biweekly income and multiply by 26. For purpose of determining child care fees in DoD Child Care program, total family income is defined as all

earned income including wages, salaries, tips, long-term disability benefits, combat pay and voluntary salary deferrals. Include all earned income such

as wages, salaries, tips, long-term disability benefits, voluntary salary deferrals, retirement or other pension income, etc., before deductions for taxes,

social security, etc. Include quarters subsistence and other allowances appropriate for the rank and status of military or civilian personnel whether

received in cash or in kind. For dual military living in government quarters include BAH-II of senior member only. Include anything else of value, even

if not taxable, that was received for providing services. DO NOT INCLUDE cost of living allowance (COLA) received in high cost areas, alimony and

child support, temporary duty allowances or reimbursements for educational expenses.

5. SPONSOR

a. NAME (LAST, First, Middle Initial)

b. YEARS OF MILITARY/CIVIL SERVICE

c. INCOME

(2) BASIC ALLOWANCE FOR HOUSING

(1) BASE PAY (Most recent leave and

(3) BASIC SUBSISTENCE ALLOWANCE

(4) OTHER EARNED INCOME AS

(Or in-kind equivalent) (Annual chart

earnings statement)

(Or in-kind equivalent)

DESCRIBED ABOVE

of minimum BAH-II)

6. SPOUSE

a. NAME (LAST, First, Middle Initial)

b. YEARS OF MILITARY/CIVIL SERVICE

c. INCOME

7. OTHER EARNED INCOME AS DESCRIBED ABOVE

8. TOTAL INCOME FOR SPONSOR, SPOUSE, AND

OTHER

SECTION III - CERTIFICATION OF SPONSOR (Required for Category I - IV. Please read the following statement carefully before signing.)

I certify that all of the above information is true and correct and that all family income of the spouse and sponsor is reported. I understand that this

information is being given in order to determine child care fees to be paid and that Federal funds are used to subsidize the cost of child care. I also

understand that the installation commander may verify the information on the application; and that deliberate misrepresenta- tion of this information

may subject me to prosecution under applicable State and Federal laws. See 18 U.S.C. Section 1001.

9. SIGNATURE OF SPONSOR*

10. SIGNATURE OF SPOUSE

11. DATE SIGNED

(YYYYMMDD)

*If signature is missing, the fees will automatically be placed at the highest level.

13. HOME ADDRESS

12. TELEPHONE NUMBERS

(List apartment number and 9-digit ZIP Code)

(Include Area Code)

a. HOME

b. WORK

(1) SPONSOR

(2) SPOUSE

SECTION IV - FOR CHILD DEVELOPMENT CENTER USE ONLY

14. CATEGORY OF APPROVAL

15. AUTHORIZED FEES

16. DATE OF APPROVAL

17. NAME OF CHILD DEVELOPMENT PROGRAM OFFICIAL

(YYYYMMDD)

DD FORM 2652, JUN 2009

PREVIOUS EDITION IS OBSOLETE.

Adobe Professional 8.0

Reset

1

1